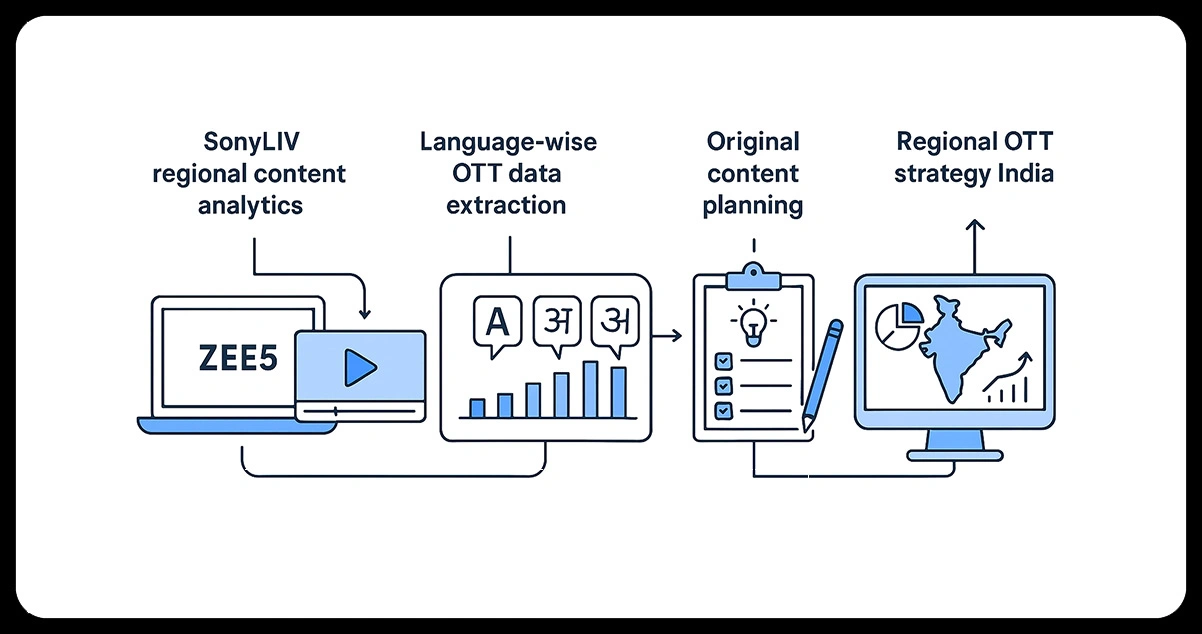

Use Case Summary

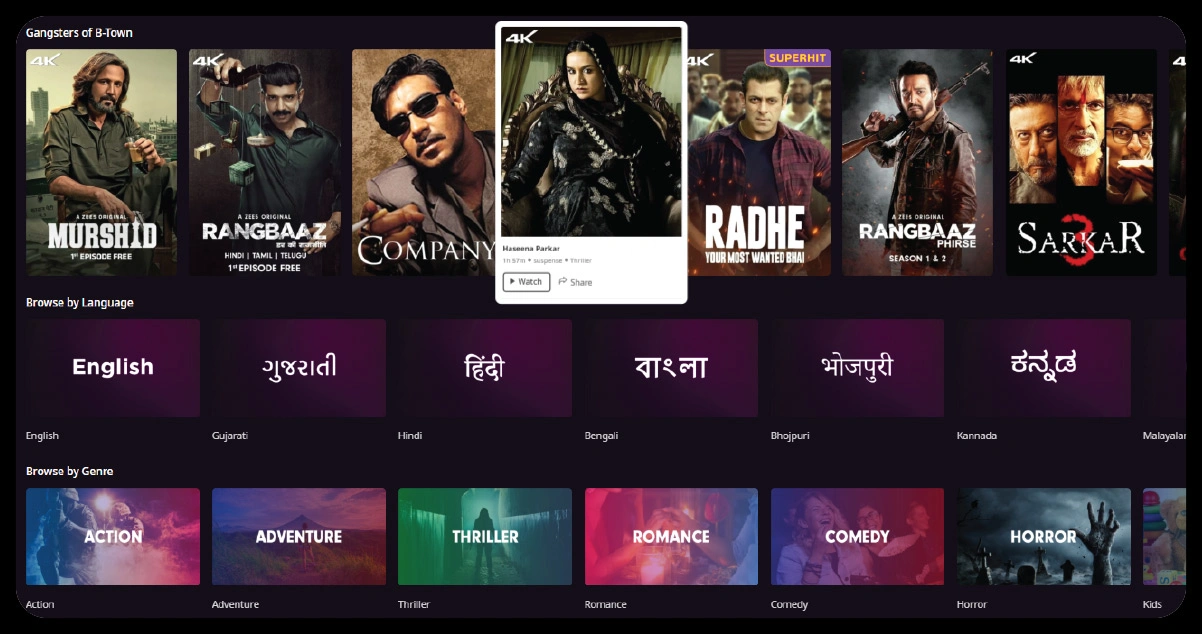

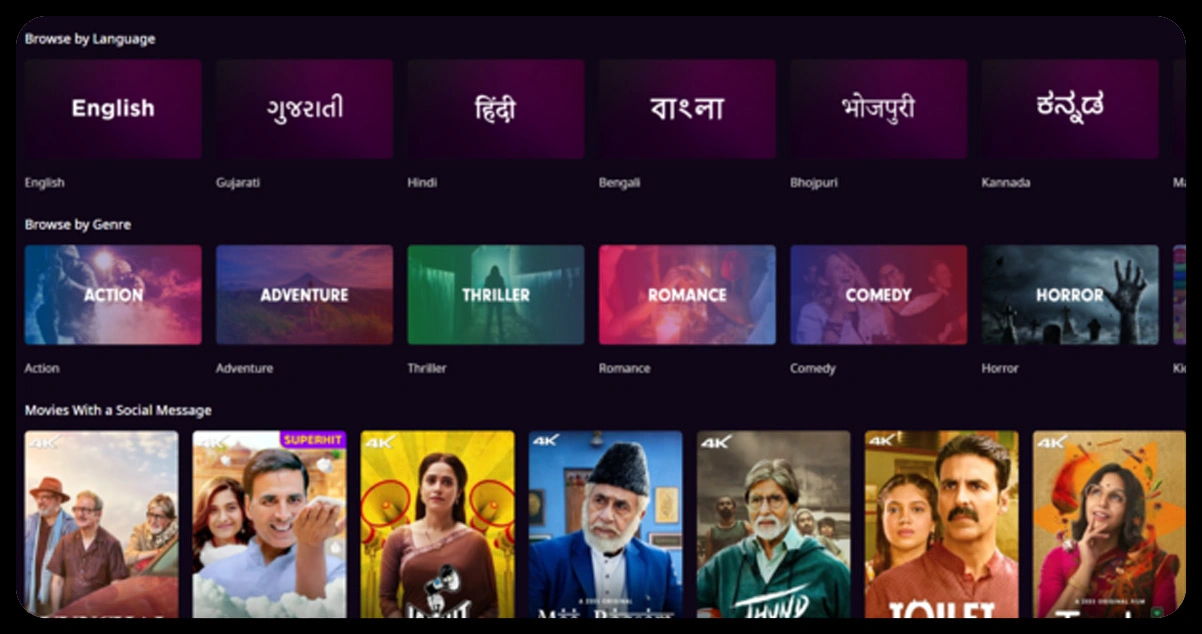

A mid-sized OTT streaming studio wanted to expand its original content portfolio in regional Indian languages. However, they lacked actionable data on existing content saturation across languages and genres on competing platforms like Zee5 and SonyLIV.

The studio partnered with OTT Scrape to run a comprehensive language-wise content gap analysis. Using scraped metadata, release timelines, genre distribution, and subtitle availability from Zee5 and SonyLIV, the studio uncovered untapped language markets and adjusted their content roadmap to develop regionally resonant originals.

Business Challenge

The Problem:

Despite producing Hindi web series and movies, the studio saw declining engagement and increased competition from regional-first OTTs like Hoichoi, Aha, and SunNXT.

They asked:

- Which Indian languages are underserved on Zee5 and SonyLIV?

- Are there genres missing in certain languages?

- Which regions lack new releases or recurring original content?

Goals:

- Identify content saturation vs scarcity across regional languages

- Map genre availability (crime, comedy, drama, romance) per language

- Recommend three underserved languages for original series production

Solution: Scraping Zee5 and SonyLIV with OTT Scrape

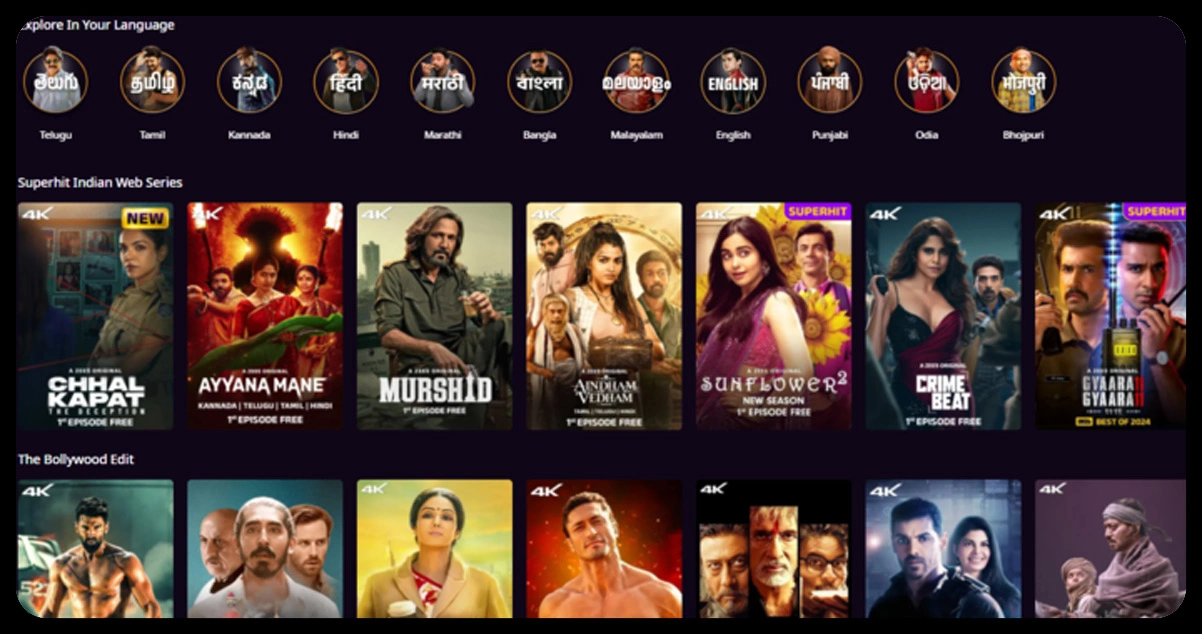

OTT Scrape deployed its custom crawler suite to extract:

- Title, language, release date

- Genre classification

- Subtitle/audio availability

- Original vs licensed content tag

- Region-specific landing sections (e.g., Tamil Originals, Marathi Drama)

Data was extracted for over 3,500 titles across both platforms using proxies and adaptive scraping.

SEO Keywords Used:

- Zee5 content scraping

- SonyLIV regional content analytics

- Language-wise OTT data extraction

- Original content planning

- Regional OTT strategy India

Sample Data Extracted (March–May 2025)

json

CopyEdit

[

{

"platform": "Zee5",

"title": "Devmanus 2",

"language": "Marathi",

"genre": "Crime Drama",

"release_date": "2025-03-18",

"type": "Original",

"episodes": 120

},

{

"platform": "SonyLIV",

"title": "Tamil Rockerz",

"language": "Tamil",

"genre": "Thriller",

"release_date": "2024-12-05",

"type": "Original",

"episodes": 8

},

{

"platform": "Zee5",

"title": "Anya’s Tutorial",

"language": "Telugu",

"genre": "Horror",

"type": "Original"

}

]

Key Findings from the Scraped OTT Data

1. Language Imbalance Identified

| Language | % of Total Content (Zee5 + SonyLIV) | Originals Share |

|---|---|---|

| Hindi | 43% | 61% |

| Tamil | 14% | 12% |

| Telugu | 12% | 9% |

| Marathi | 9% | 6% |

| Bengali | 6% | 4% |

| Kannada | 3% | 2% |

| Gujarati | <1% | <0.5% |

Gujarati, Kannada, and Bengali were heavily underrepresented in original content.

2. Genre Gaps by Language

- Crime thrillersdominated Hindi & Telugu; missing in Bengali & Marathi

- Comedyoriginals were rare in Kannada & Gujarati

- Romantic dramaswere saturated in Hindi but absent in Tamil & Marathi

3. Release Timelines Showed Inconsistency

- Tamil shows on SonyLIV had large gaps between releases (avg. 120+ days)

- Zee5 released no Kannada original content in the last 12 months

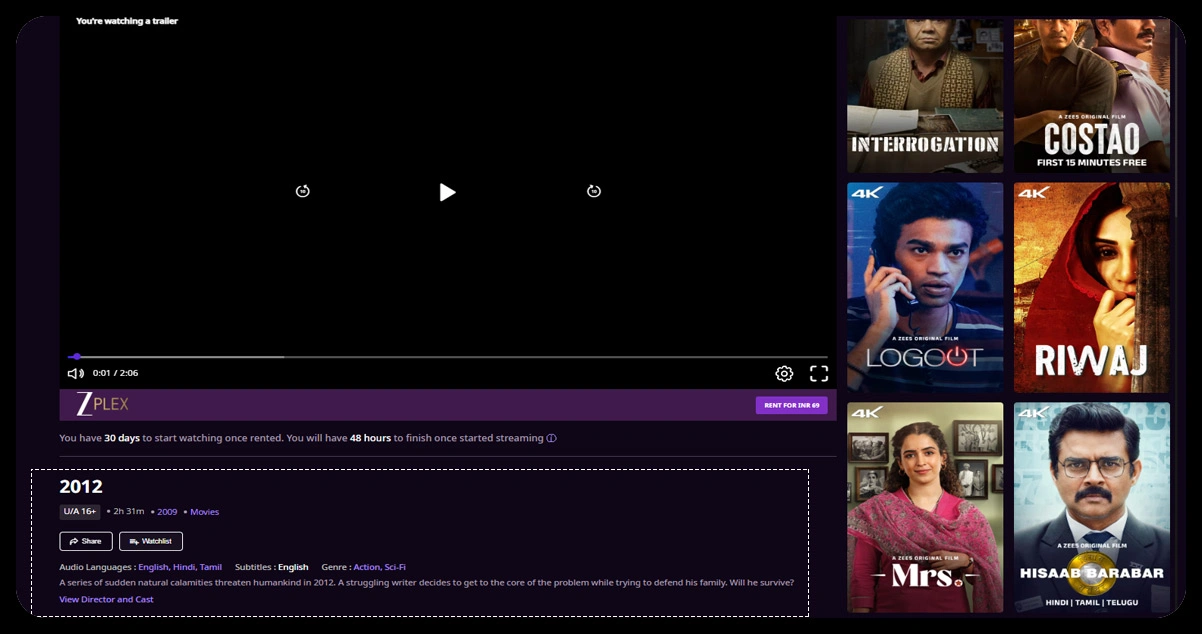

4. Subtitle and Audio Trends

- 89% of Hindi content had English subtitles

- Only 30% of Bengali content was available with English subs

- No Marathi or Gujarati titles had audio-dubbed versions

Strategic Recommendations from OTT Scrape

Based on data:

- Launch original series in Gujarati, Bengali, and Kannada

- Focus on light comedy and urban slice-of-life dramas in underserved languages

- Prioritize English subtitle and audio-dubbed support to boost accessibility

- Launch 3-title mini-slate with one release per quarter in regional zones

Outcome & Results

After 4 months of implementation:

| Metric | Before (Q1 2025) | After (Q2-Q3 2025) |

|---|---|---|

| Regional Languages in Pipeline | 1 | 4 |

| Original Titles Greenlit | 2 | 6 |

| Engagement from Tier-2 Cities | +7% | +21% |

| Licensing Offers from Partners | 3 | 9 |

The studio saw a 2x increase in pitch approvals from regional distributors and a 34% increase in organic search for regional titles across their OTT app.

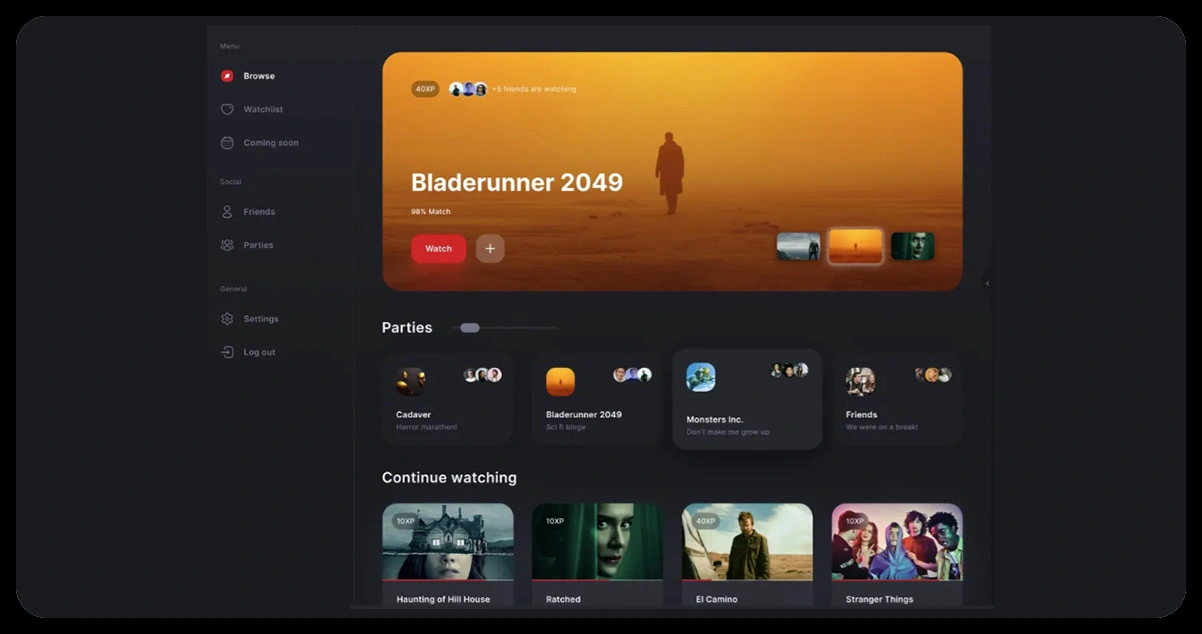

Dashboards Delivered by OTT Scrape

- Language-wise genre heatmap

- Subtitle/audio availability charts

- Release gap timeline (per language)

- Top-performing genres vs underutilized genres

- Alerts on competitor platform updates (Zee5, SonyLIV)

Why OTT Scrape Was Chosen

| Feature | OTT Scrape Advantage |

|---|---|

| Multi-language parsing | Supports over 10 Indian scripts |

| Subtitle/audio tag extraction | Full metadata scrape with availability tagging |

| Real-time release alerts | Webhook/API integration for competitor content |

| Custom dashboards | Delivery via Power BI + Google Data Studio |

| Geo-proxy scraping | Region-specific results (India metro & rural zones) |

Final Takeaway

This case proves that regional content planning without data is a gamble. By scraping data from Zee5 and SonyLIV, the studio identified clear gaps in language representation and genre availability, enabling them to enter markets their competitors were ignoring.

With OTT Scrape, they turned passive assumptions into data-backed execution, aligning their original content slate with real demand—region by region, language by language.

Our office info

540 Sims Avenue, #03-05, Sims Avenue Centre Singapore, 387603 Singapore