Use Case Summary

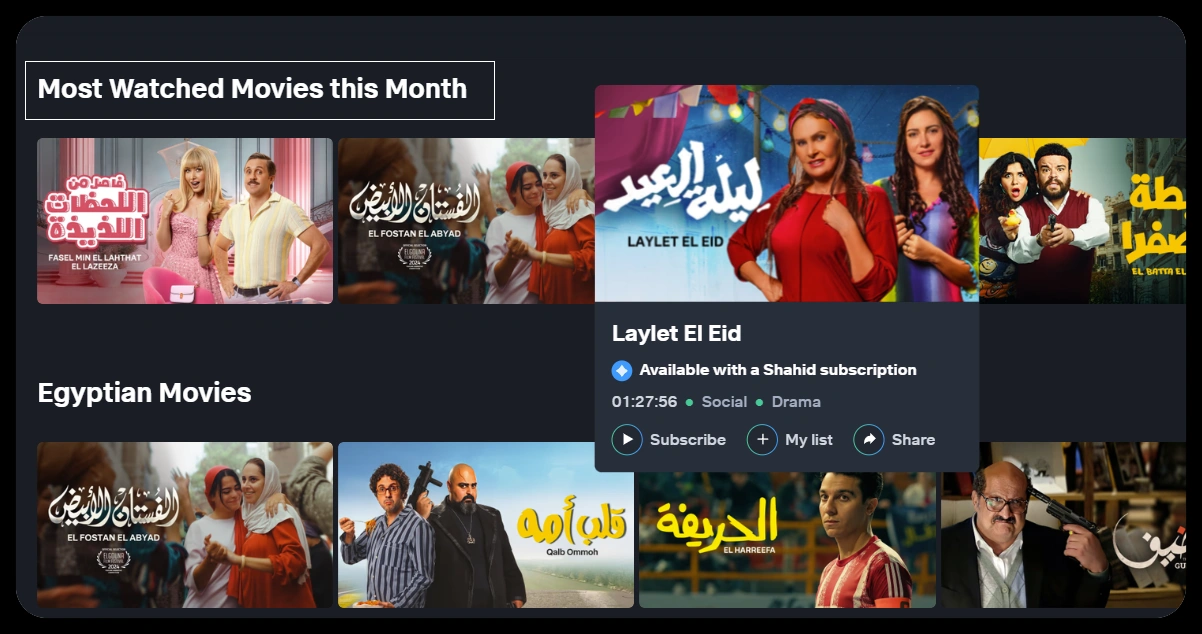

A multinational media network operating across the Middle East and North Africa (MENA) wanted to improve its regional ad strategy and make smarter dubbing investments in Arabic OTT content. However, it lacked access to structured data across top regional platforms like Shahid and StarzPlay.

The company partnered with OTT Scrape to scrape and analyze Arabic content metadata, viewer trends, subtitle availability, and genre-level performance on Shahid and StarzPlay. The insights enabled the client to target regional ads more effectively and plan language dubbing rollouts based on true content demand.

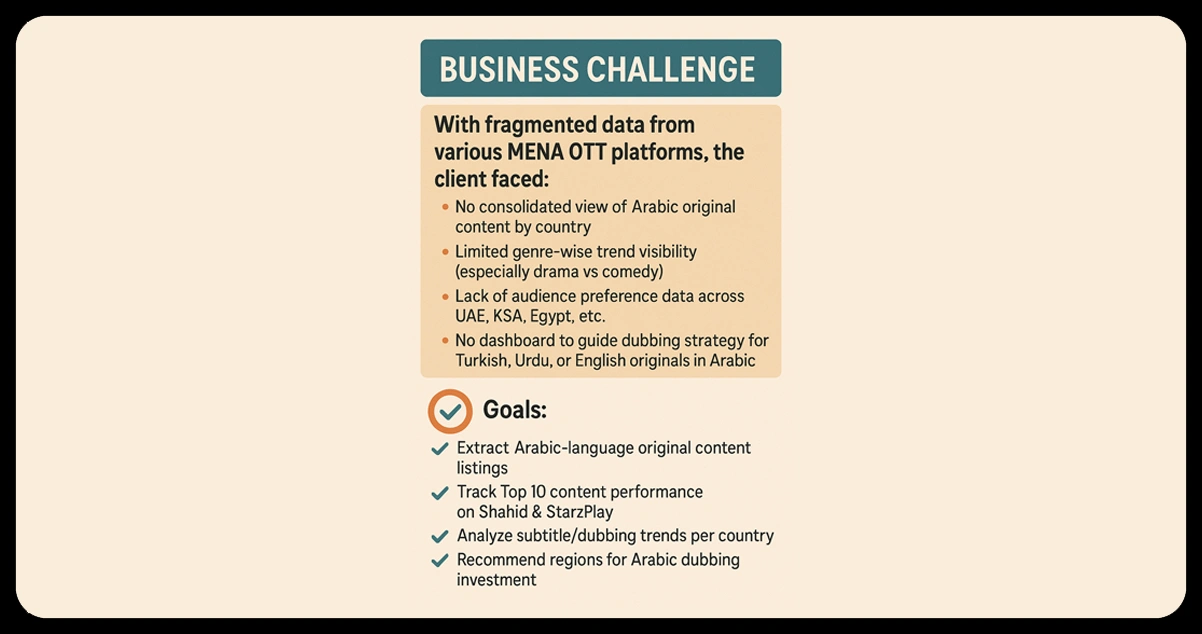

Business Challenge

The Problem:

With fragmented data from various MENA OTT platforms, the client faced:

- No consolidated view of Arabic original content by country

- Limited genre-wise trend visibility (especially drama vs comedy)

- Lack of audience preference data across UAE, KSA, Egypt, etc.

- No dashboard to guide dubbing strategy for Turkish, Urdu, or English originals in Arabic

Goals:

- Extract Arabic-language original content listings

- Track Top 10 content performance on Shahid & StarzPlay

- Analyze subtitle/dubbing trends per country

- Recommend regions for Arabic dubbing investment

- Guide regional ad targeting by genre and language preference

Solution: Custom MENA OTT Scraping Engine by OTT Scrape

OTT Scrape developed a specialized scraping workflow with Arabic script handling and geo-proxy infrastructure to track content across:

- Shahid (MBC Group) – Original shows, Ramadan specials, Gulf series

- StarzPlay Arabia – Acquired and dubbed Hollywood/Asian titles, Originals

The pipeline included:

- Language tag parsing

- Genre and release year classification

- Rank tracking (Top 10 / Trending Today)

- Subtitle/audio language detection

- View count parsing (where public)

SEO Keywords Used:

- Arabic OTT content analysis

- Shahid scraper MENA

- StarzPlay data extraction

- Arabic dubbing trends

- MENA streaming analytics

Sample Scraped Data (April–May 2025)

json

CopyEdit

[

{

"platform": "Shahid",

"title": "Al Thaman",

"language": "Arabic",

"genre": "Drama",

"region": "KSA",

"rank": 2,

"subtitle_languages": ["English", "French"],

"dubbed": false

},

{

"platform": "StarzPlay",

"title": "Power Book II: Ghost",

"language": "English",

"dubbed": true,

"dubbed_language": "Arabic",

"region": "UAE",

"rank": 4,

"genre": "Crime, Drama"

}

]

Key Metrics Delivered

| Metric | Description |

|---|---|

| Arabic Originals by Country | Tracked per UAE, KSA, Egypt, Jordan, Morocco |

| Genre-wise Top 10 Performance | Filtered by Arabic vs dubbed content |

| Subtitle/Dubbing Availability | Subtitle/dubbed tags by language |

| Content Lifecycle | Entry, peak, and exit from trending rankings |

| Viewer Preference Trends | Inferred via trending lists and metadata scraping |

Insights Gained

Arabic Originals Dominate Shahid, Dubbed Titles Lead on StarzPlay

- 85% of Shahid’s Top 10 content was Arabic-first

- On StarzPlay, 70% of Top 10 were English or Turkish shows dubbed in Arabic

2. Genre Performance by Region

| Genre | UAE Top 3 | KSA Top 3 | Egypt Top 3 |

|---|---|---|---|

| Drama | ✅ | ✅ | ✅ |

| Comedy | ✅ | ❌ | ✅ |

| Reality TV | ❌ | ✅ | ❌ |

KSA had a higher preference for reality & family drama, while Egypt favored romantic comedy.

3. Dubbing Investment Signals

- Turkish content dubbed in Arabic performed better than English originals

- Urdu shows with Arabic subtitles had higher CTR in Gulf markets

- Only 40% of StarzPlay Arabic dubs had accurate metadata or SEO tags

Strategic Recommendations by OTT Scrape

- Invest in Arabic dubbing for Turkish and Urdu series, especially in UAE and KSA

- Focus Arabic subtitling efforts on English crime/thriller content

- Produce new Arabic originals in comedy for Egypt and family drama for KSA

- Use Shahid’s Ramadan trend patterns to plan seasonal ad campaigns

Outcome & Results

| KPI | Before (Q1 2025) | After (Q2–Q3 2025) |

|---|---|---|

| CTR on Arabic campaigns | 2.8% | 5.4% |

| Dubbing investment ROI (avg.) | 1.4x | 2.3x |

| Time to decide dubbing strategy | 4 weeks | 7 days |

| Content views (KSA + UAE markets) | +9% | +21% |

The data enabled faster decisions, more targeted regional ads, and reduced content localization risk.

Dashboards Delivered

OTT Scrape built Power BI dashboards with:

- Arabic content rank tracker by country

- Genre heatmaps by market (Egypt, UAE, KSA, Jordan)

- Subtitle/dubbing availability chart

- Entry/exit content trends

- Monthly Arabic title launches across Shahid & StarzPlay

Technical Advantages of OTT Scrape

| Feature | OTT Scrape Capability |

|---|---|

| Arabic language parsing | Supports Unicode + right-to-left script extraction |

| Geo-proxy scraping | IPs from UAE, Egypt, KSA to ensure local results |

| Multi-platform tracker | Unified Shahid + StarzPlay data in one interface |

| Real-time data feed | Updates within 12–24 hrs of content shifts |

| Metadata cleaning | Standardized genre, language & platform tags |

Final Thoughts

In MENA’s fast-growing OTT landscape, Arabic content is not just cultural—it’s commercial. By scraping Shahid and StarzPlay, OTT Scrape gave the client region-specific clarity on what’s working, what’s not, and where to invest next.

From dubbing decisions to ad strategies, real-time Arabic content intelligence is becoming essential.

Our office info

540 Sims Avenue, #03-05, Sims Avenue Centre Singapore, 387603 Singapore