Use Case Summary

A global content licensing studio was actively exploring new titles to acquire or co-produce for U.S. audiences. Instead of relying solely on delayed viewership reports or insider signals, the team needed real-time visibility into what U.S. audiences were watching.

The studio partnered with OTT Scrape to deploy a Netflix US Top 10 content scraper, delivering daily data on trending shows and movies. The scraped data was used to identify genres, titles, and release patterns that consistently performed well—guiding smarter acquisition, investment, and pitching strategies.

Business Challenge

The Problem:

Licensing teams typically depend on:

- Studio deal reports (which are delayed or limited)

- Quarterly platform updates (non-transparent)

- Manual Netflix browsing (inefficient)

What they lacked was:

- Daily ranking data

- Genre-wise U.S. demand trends

- Show lifecycle tracking (entry, peak, drop)

- Metadata to contextualize performance (genre, season, language)

Goals:

- Scrape and monitor Netflix U.S. Top 10 daily

- Track title movements (new entries, exits, rank change)

- Analyze genre trends and high-performing formats

- Deliver reports and alerts for studio acquisition teams

SEO Keywords Used:

- Netflix US Top 10 scraping

- Real-time content tracking

- Studio licensing insights

- OTT content trend analytics

- Netflix ranking data API

Solution: Real-Time Top 10 Scraping via OTT Scrape

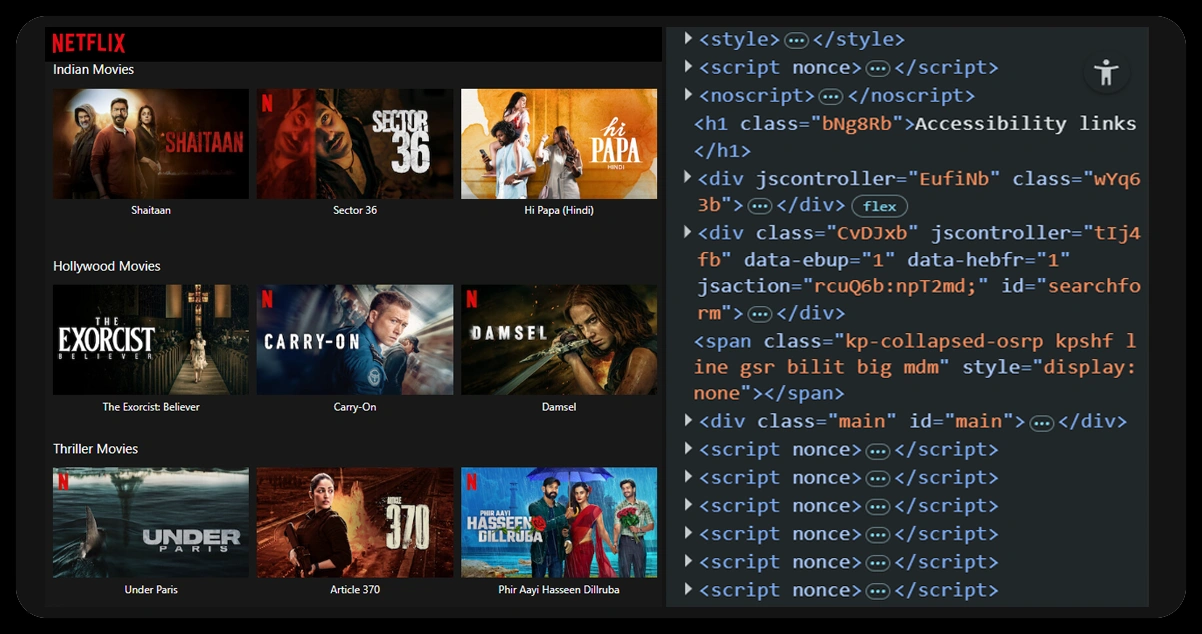

OTT Scrape deployed a U.S. geo-proxied content scraper to extract:

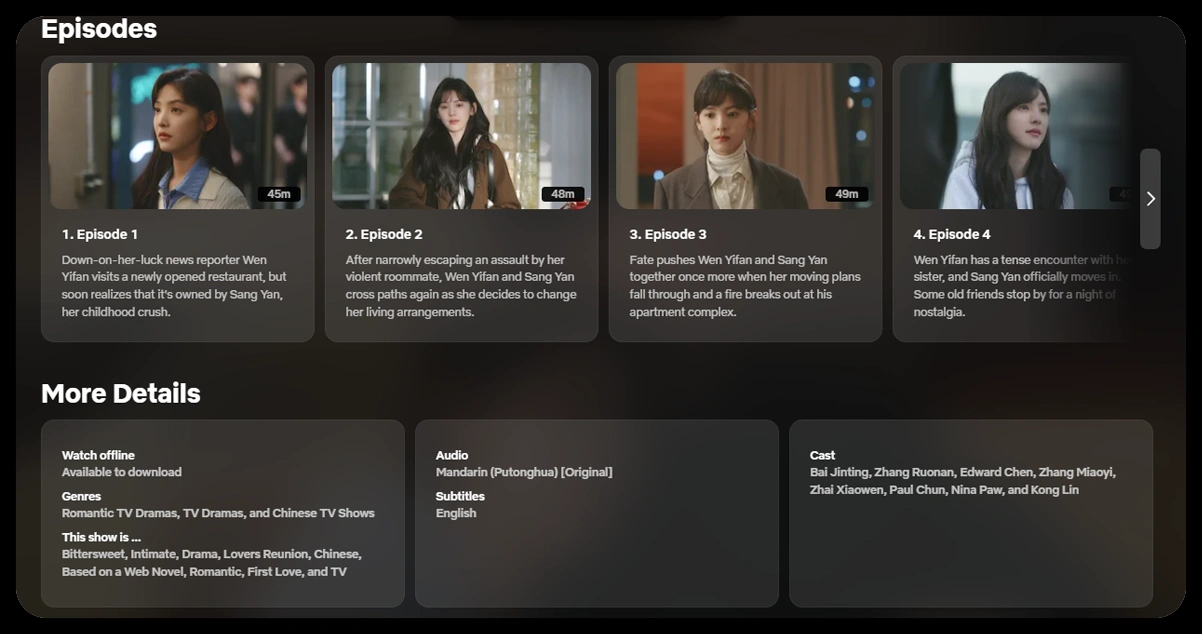

- Title, rank, type (movie/series), season/episode

- Entry date and duration in Top 10

- Genre and tags (action, comedy, documentary, etc.)

- Language and subtitle availability

- Drop-off and re-entry signals

Scraping occurred daily at midnight U.S. EST, stored in a time-series database, and delivered to the studio via:

- REST API

- Weekly PDF dashboards

- CSV exports and Google Sheets sync

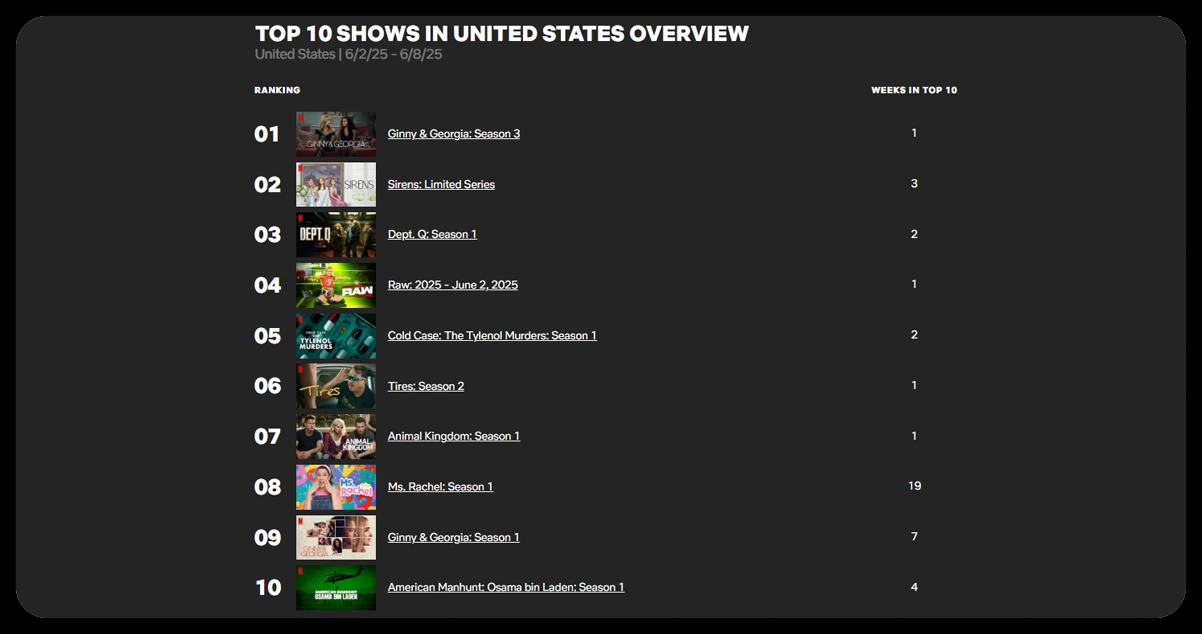

Sample Scraped Data – June 2025

json

CopyEdit

[

{

"platform": "Netflix US",

"date": "2025-06-09",

"rank": 1,

"title": "Bridgerton: Season 3",

"type": "Series",

"genre": "Romance, Drama",

"language": "English",

"days_in_top_10": 10

},

{

"platform": "Netflix US",

"date": "2025-06-09",

"rank": 5,

"title": "Atlas",

"type": "Movie",

"genre": "Sci-Fi, Action",

"language": "English",

"days_in_top_10": 4

}

]

Key Metrics Delivered by OTT Scrape

| Metric | Purpose |

|---|---|

| Rank Daily Movement | See how fast titles climb or fall |

| Days in Top 10 | Determine staying power of content |

| Genre-by-Rank Correlation | Understand what genres dominate U.S. rankings |

| Series vs Movie Ratio | Format-based acquisition strategy |

| Entry/Exit Alerts | Track new breakouts or lost opportunities |

Insights Gained by Licensing Team

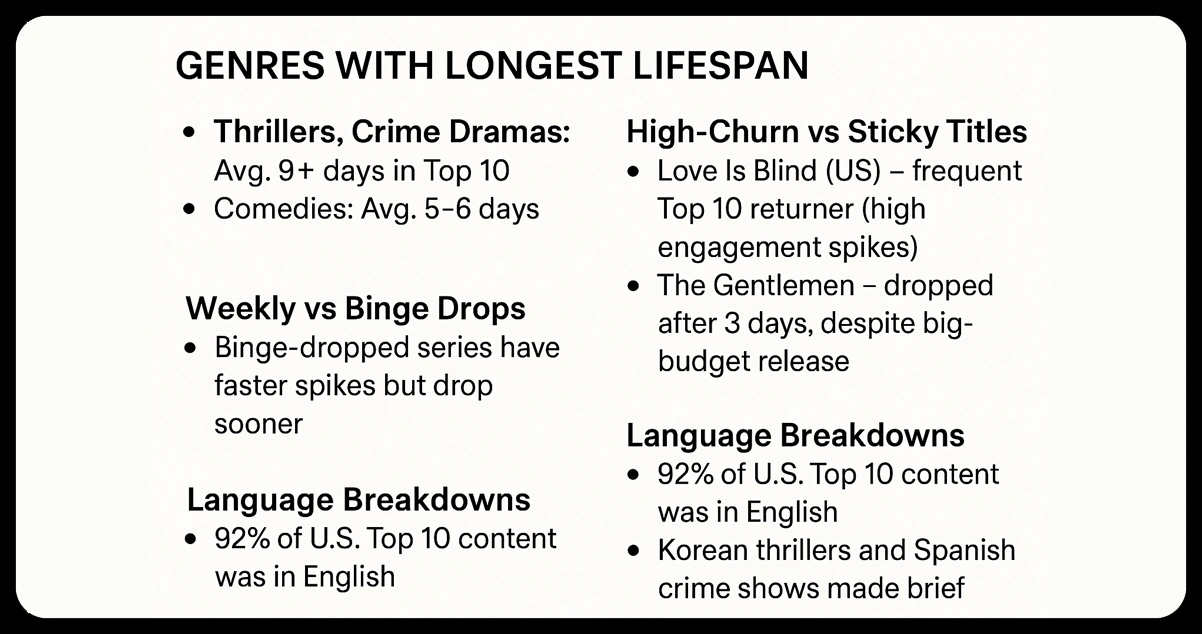

1. Genres with Longest Lifespan

- Thrillers, Crime Dramas: Avg. 9+ days in Top 10

- Comedies: Avg. 5–6 days

- Docuseries: Short but frequent re-entries

2. High-Churn vs Sticky Titles

- Love Is Blind (US) – frequent Top 10 returner (high engagement spikes)

- The Gentlemen – dropped after 3 days, despite big-budget release

3. Weekly vs Binge Drops

- Binge-dropped series have faster spikes but drop sooner

- Weekly-release docuseries held better rank over time

4. Language Breakdowns

- 92% of U.S. Top 10 content was in English

- Korean thrillers and Spanish crime shows made brief appearances

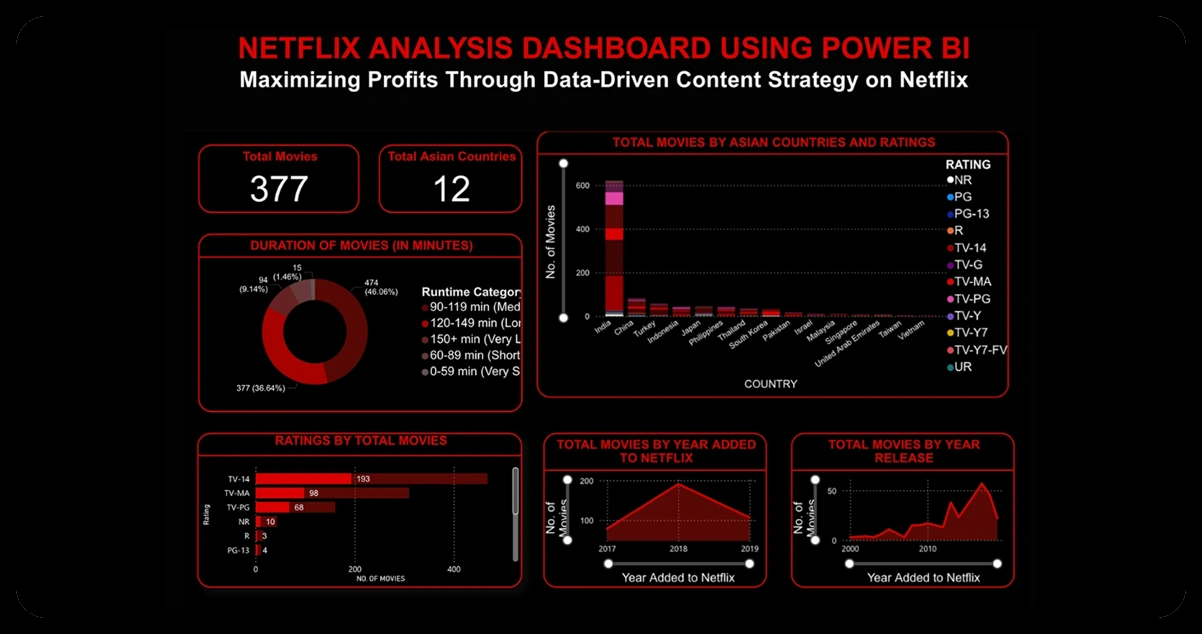

Custom Dashboard Views

OTT Scrape delivered insights through a Power BI dashboard featuring:

- Daily Top 10 graph

- Entry vs exit patterns over 30 days

- Genre heatmaps across weeks

- Rank volatility index

- Alerts for new Top 10 entrants (email/slack)

Outcome & Impact

| KPI | Before OTT Scrape | After OTT Scrape |

|---|---|---|

| Content deals closed (quarterly) | 3 | 7 |

| Average licensing turnaround time | 6–8 weeks | 3–4 weeks |

| Deal rejections due to mismatch | 35% | 15% |

| ROI on licensed titles (Top 10 match) | ~22% | ~49% |

Using real-time data, the studio cut deal negotiation time in half and acquired 2 breakout shows that later hit the Top 10 globally.

Studio Recommendations Based on OTT Scrape

- Focus on female-led drama series in the 6–8 episode format

- Target limited docuseries for faster production + guaranteed visibility

- Re-license trending old hits seeing repeat Top 10 cycles

- Avoid overproduced thrillers with short shelf lives

Why OTT Scrape Was Chosen

| Feature | OTT Scrape Advantage |

|---|---|

| U.S. Proxy & Localized Crawling | Accurate geo-specific Top 10 data |

| Real-Time Frequency (Daily) | Updated within 24 hours |

| Genre Parsing | Genre normalization + multi-genre mapping |

| Format Classification (Movie/Series) | Enables format-level strategy |

| API + Dashboard + Alerts | Full stack insights delivered seamlessly |

Strategic Value for Licensing Teams

- Track U.S. demand in real time — no more lagging reports

- Use Top 10 trends to predict genre breakout cycles

- Make smarter deals using data, not assumptions

- Identify undervalued older titles seeing new spikes

- Improve catalog ROI and reduce licensing waste

Final Thoughts

Top 10 content is more than a popularity metric—it’s a licensing compass. With OTT Scrape’s real-time Netflix U.S. Top 10 tracking, studios can move from reactive to proactive—backed by data, driven by demand.

Whether you're acquiring, producing, or co-financing content, knowing what’s trending today helps you predict what wins tomorrow.

Our office info

540 Sims Avenue, #03-05, Sims Avenue Centre Singapore, 387603 Singapore