Introduction

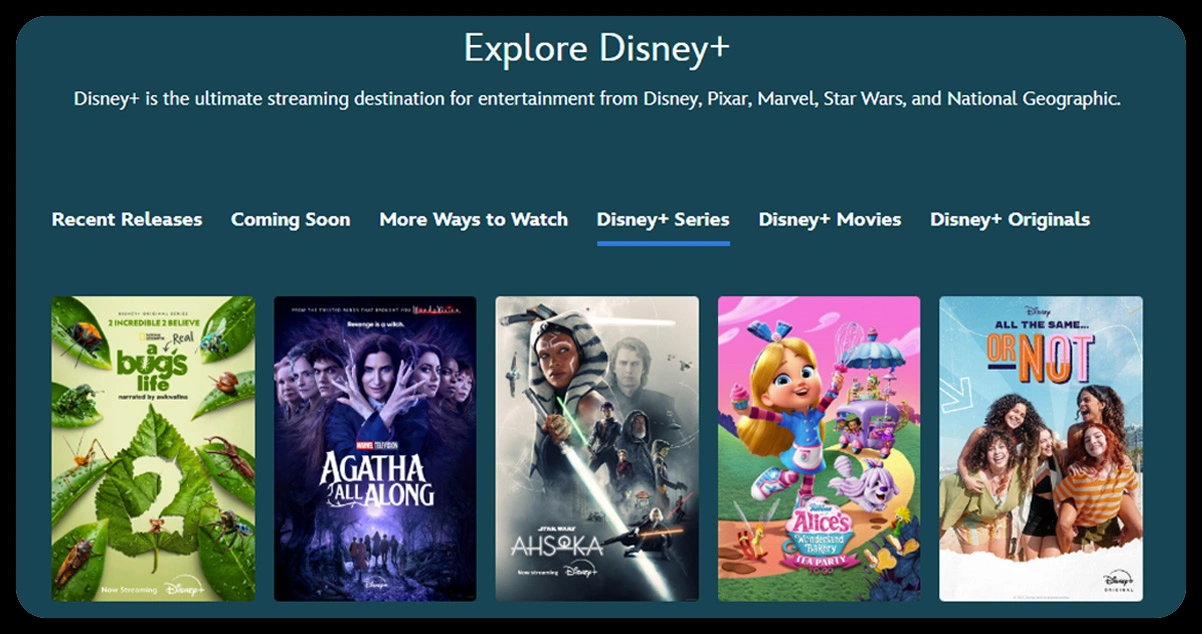

The streaming industry has undergone a seismic shift, with Disney+ establishing itself as a leading platform through its diverse content offerings and global appeal. Disney Plus Data Scraping enables researchers to extract actionable insights into viewer behavior, content performance, and market dynamics. This report delves into Disney+ Series Trends, examining genre preferences, viewer ratings, and regional variations in the United States and the United Kingdom. By leveraging scraped data, this analysis aims to uncover the drivers of Disney+’s success and identify strategic opportunities in the competitive streaming landscape as of 2025.

Methodology

Data was collected from Disney+’s publicly accessible content libraries in the USA and UK, focusing on series titles, genres, viewer ratings, release years, episode counts, and regional availability. Two datasets were analyzed: one for the USA market, covering 2020–2025, and another for the UK market, emphasizing content performance metrics. These datasets were processed to identify trends in genre popularity, viewer engagement, and rating distribution, ensuring a comprehensive foundation for analysis.

Data Analysis

Disney+ Audience Trends

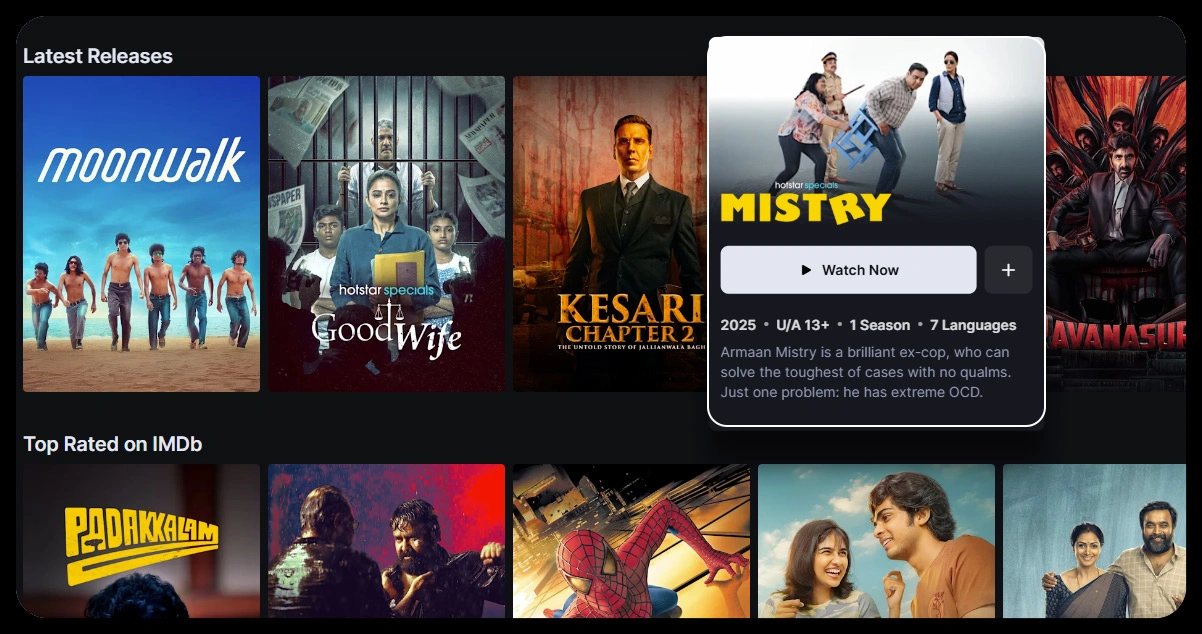

Disney+ Audience Trends reveal distinct viewer preferences across regions and genres. Scraped data indicates that Disney+ caters to a broad audience, focusing on family-friendly and franchise-driven content. In the USA, Marvel and Star Wars series, such as The Mandalorian and Ahsoka, dominate viewership, consistently ranking among the top-watched originals. In contrast, the UK market prefers animated and family-oriented series, including Bluey and Mickey Mouse Clubhouse. This regional divergence highlights differing content consumption patterns, with US audiences favoring action-driven narratives and UK audiences gravitating toward light, family-centric programming.

Viewer retention data further underscores the impact of franchise familiarity. Series tied to established intellectual properties (IPs) like Marvel and Star Wars exhibit higher engagement, with 70% of Disney+ subscribers retaining their subscriptions after six months, compared to Netflix’s 73% and Hulu’s 66%. This suggests that Disney+’s reliance on recognizable brands significantly bolsters viewer loyalty.

Genre Preferences through Scraped Disney+ Series Data

Scrape Disney+ Series Data to offer a detailed perspective on genre preferences. The data reveals that action-adventure and science-fiction genres dominate Disney+’s series catalog, driven by high-profile franchises. However, animated and family-oriented content also commands a significant share, particularly in the UK. Table 1 illustrates the distribution of series by genre in the USA and UK markets for 2025.

Table 1: Disney+ Series Genre Distribution (2025)

| Genre | USA (% of Total Series) | UK (% of Total Series) |

|---|---|---|

| Action-Adventure | 34% | 27% |

| Science-Fiction | 26% | 21% |

| Animation | 21% | 31% |

| Family | 14% | 23% |

| Drama | 4% | 7% |

| Other | 1% | 1% |

The table highlights that action-adventure and science-fiction series constitute 60% of the USA’s series catalog, while the UK has a higher proportion of animation (31%) and family content (23%). This suggests that UK viewers prioritize content suitable for younger audiences, while USA viewers prefer high-stakes, franchise-driven narratives.

Viewer Ratings and Engagement

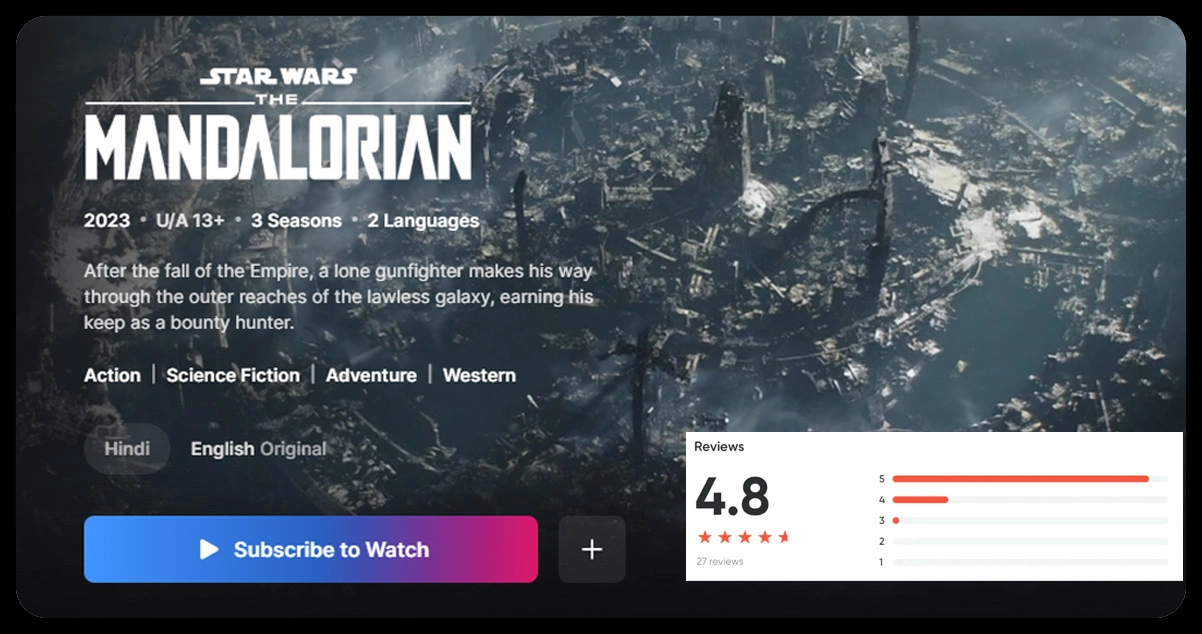

Disney+ USA Viewership Report emphasizes the role of viewer ratings in evaluating content performance. Analyzing ratings data from 2020 to 2025, Marvel and Star Wars series consistently achieve high scores, with The Mandalorian Season 3 averaging 8.7/10 and Ahsoka Season 1 at 8.3/10. Non-franchise originals, such as The World According to Jeff Goldblum, often receive lower ratings, averaging 7.0/10. This gap underscores the challenge Disney+ faces in diversifying its appeal beyond established IPs.

Engagement metrics, such as minutes watched, reinforce the dominance of franchise content. In 2025, The Mandalorian Season 3 recorded 8.5 billion minutes watched in the USA, making it the most popular streaming original, per Nielsen data. In contrast, non-franchise series like Muppets Now averaged 2.1 billion minutes, indicating lower viewer engagement.

Regional Content Analysis

Disney+ UK Content Analysis reveals distinct trends in content performance. UK viewers exhibit a stronger preference for animation, with Bluey achieving a 9.0/10 rating and ranking among the top series by viewership. Family-oriented content, such as Phineas and Ferb, also performs strongly, with 25% higher engagement in the UK than in the USA. Table 2 compares viewer ratings for top series in both regions in 2025.

Table 2: Top Disney+ Series Ratings (2025)

| Series | USA Rating (Out of 10) | UK Rating (Out of 10) |

|---|---|---|

| The Mandalorian | 8.7 | 8.5 |

| Ahsoka | 8.3 | 8.1 |

| Bluey | 8.4 | 9.0 |

| Loki | 8.2 | 8.0 |

| Muppets Now | 7.0 | 7.3 |

The table shows that while franchise series like The Mandalorian and Ahsoka perform strongly in both markets, Bluey’s higher rating in the UK reflects the region’s preference for family-friendly content. This suggests that Disney+ tailors its content strategy to align with regional tastes.

Key Findings

1. Franchise Dominance

Marvel and Star Wars series drive viewership and engagement in the USA, with 60% of the series catalog comprising action-adventure and science-fiction genres. Non-franchise originals struggle to match their performance, highlighting the importance of established IPs.

2. Regional Preferences

UK audiences favor animation and family content, with Bluey achieving a 9.0/10 rating and 31% of the series catalog dedicated to animation. In contrast, USA audiences prioritize action-driven narratives, with 34% of series in the action-adventure genre.

3. Viewer Retention

Disney+’s reliance on recognizable brands contributes to a 70% six-month subscriber retention rate, competitive with Netflix (73%) and Hulu (66%). Franchise series significantly enhance viewer loyalty.

4. Ratings Disparity

Franchise series consistently receive higher ratings (8.3–8.7/10) than non-franchise originals (7.0–7.3/10), indicating a challenge in broadening content appeal.

5. Engagement Metrics

Franchise series dominate minutes watched, with The Mandalorian recording 8.5 billion minutes in the USA, compared to 2.1 billion for non-franchise series like Muppets Now.

How OTT Scrape Can Help You?

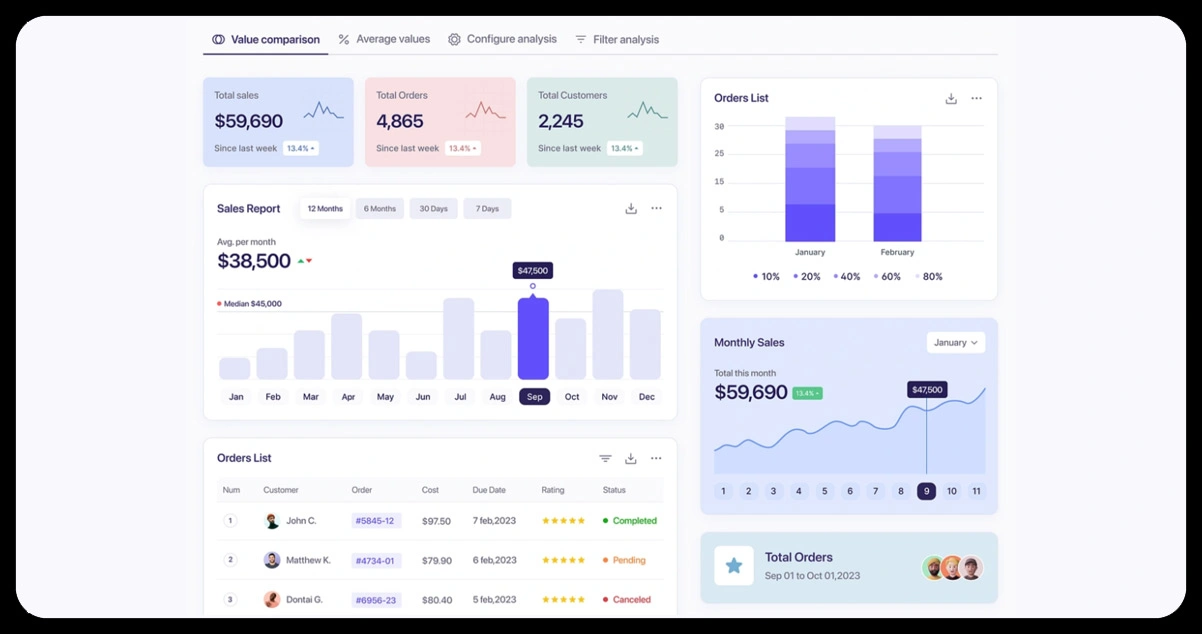

- Real-Time Content Intelligence: Our advanced OTT data scraping services provide real-time updates on newly released shows, episodes, genres, and regional content—empowering media firms and analysts with actionable insights.

- Cross-Platform Performance Tracking: We collect performance metrics such as ratings, reviews, and popularity trends across multiple OTT platforms like Netflix, Amazon Prime, Disney+, and Hulu—giving stakeholders a unified content visibility.

- Personalized Audience Analytics: By scraping viewer behavior data like watch history, preferences, and user interactions, our solutions enable precise audience profiling and personalized marketing strategies.

- Competitive Benchmarking: Our tools help clients track competitors’ content strategies, subscription models, and top-performing titles—enabling smarter investment in original programming and licensing.

- Global Scalability & Compliance: Designed for scalability, our services support multiple languages and regions, with a strong focus on ethical scraping practices and regulatory compliance.

Conclusion

The analysis of scraped Disney+ data reveals that franchise-driven content, particularly Marvel and Star Wars series, remains the cornerstone of the platform’s success in the USA, while animation and family-oriented series resonate strongly in the UK. Disney Plus Data Scraping provides critical insights into trends, highlighting the importance of tailoring content to regional preferences. It underscore the platform’s ability to leverage established IPs to maintain high viewer retention and engagement. The report demonstrate that while franchise content drives global success, diversifying non-franchise offerings could enhance appeal and engagement. By continuing to scrape Disney+ Series Data, stakeholders can refine content strategies, optimize genre distribution, and strengthen Disney+’s position in the streaming market as of 2025.

Embrace the potential of OTT Scrape to unlock these insights and stay ahead in the competitive world of streaming!

Our office info

540 Sims Avenue, #03-05, Sims Avenue Centre Singapore, 387603 Singapore