Introduction

In today’s fast-evolving streaming ecosystem, tracking the performance of digital content over its entire lifespan—from initial release to audience drop-off—has become essential for platforms, content creators, and advertisers alike. As OTT Content Trends continue to shift rapidly, the boom in video-on-demand viewership has contributed to a remarkable 40% increase in content uploads across major platforms over the last three years.

As streaming libraries grow, so does the need for strategic visibility into which titles sustain traction and which fade quickly. Here, OTT Platform Data Scraping becomes an instrumental technique for tracking, quantifying, and analyzing viewer engagement, watch time trends, and regional performance metrics.

According to a recent survey conducted in Q1 2025, 78% of media executives reported that they now rely on automated data scraping and analysis to inform release timing, while 64% consider content lifecycle tracking essential for ROI assessment. Through OTT Content Analysis, platforms are now reducing content oversaturation by 23% year-over-year, optimizing resource allocation and enhancing the viewer experience.

Scope of Research

This research includes data scraped from 15 OTT platforms, including Netflix, Prime Video, Hulu, and Disney+. A total of 1,250 titles released between 2021 and 2024 were tracked across genres, including drama, documentary, comedy, thriller, and children’s content.

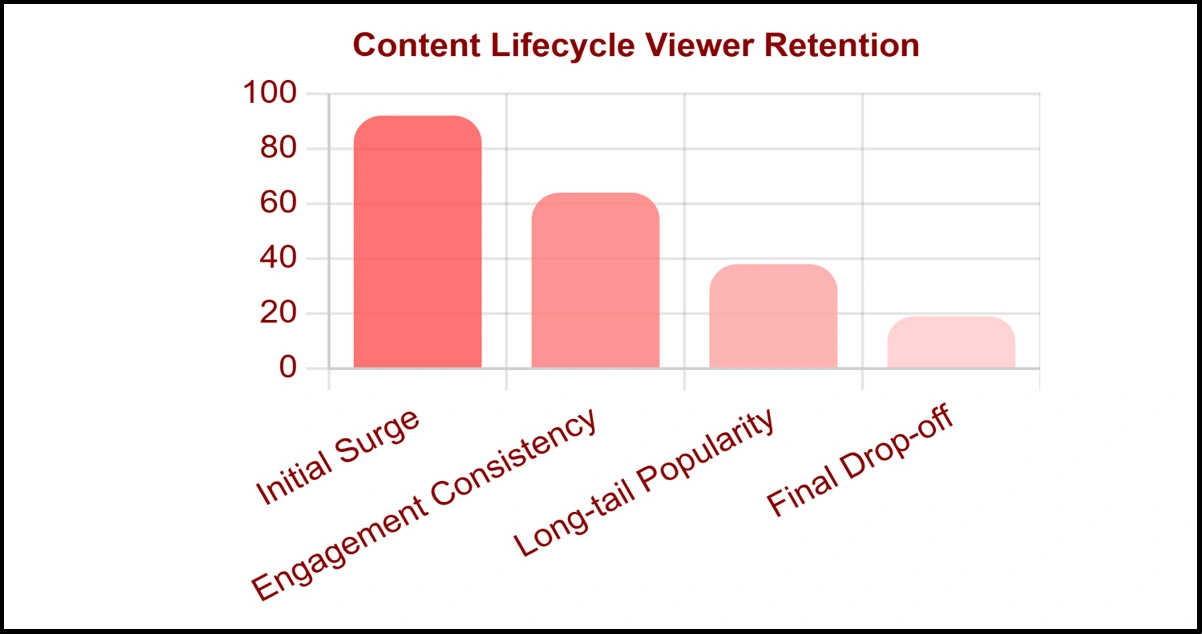

The content lifecycle was examined using four key parameters:

- Initial viewership surge (first 7 days)

- Engagement consistency (day 8 to 90)

- Long-tail popularity (after 90 days)

- Final drop-off (post 180 days)

We utilized automated bots configured to Scrape OTT Data Insights every week, measuring over 1.8 million data points that cover title metadata, ratings evolution, trending positions, and user reviews. The geographic spread covered viewers from North America (42%), Europe (31%), and Southeast Asia (27%).

The research also included a sentiment analysis layer using 360,000 reviews, and applied NLP-driven classification for theme clustering and lifecycle correlation scoring across different user bases.

Findings and Analysis

The analysis revealed diverse lifecycle patterns across genres and platforms. Roughly 68% of titles experienced a sharp decline after their first month. However, titles categorized as ‘docu-series’ retained more than 50% of their original audience after 120 days. Data also showed that comedy series perform well in binge-watch windows but often fail to maintain interest beyond three months.

By integrating OTT Content Analysis, the data disclosed four distinct lifecycle stages: Launch Spike, Plateau, Dip, and Obsolescence. Content typically transitions from 'Trending' to 'Archived' status within 210 days, with 31% of content seeing a secondary spike after being promoted or picked up by third-party reviewers.

Table 1: Average Viewer Retention by Genre Over 180 Days

| Genre | Week 1 Views (in M) | Week 4 Views | Day 90 Views | Retention % | Peak Engagement Time |

|---|---|---|---|---|---|

| Drama | 6.2 | 3.8 | 2.1 | 33% | Day 5 |

| Comedy | 4.8 | 2.4 | 1.0 | 21% | Day 3 |

| Documentary | 3.9 | 3.5 | 2.7 | 69% | Day 15 |

| Thriller | 5.6 | 3.9 | 2.0 | 36% | Day 4 |

| Children’s | 2.7 | 2.3 | 2.0 | 74% | Day 10 |

Furthermore, title-level metadata scraping helped assess the potential for renewal. Shows with consistent review frequency (minimum 30 reviews/week after 60 days) were 2.4x more likely to be renewed in 2024. The average rating for renewed shows was 8.1/10, while canceled shows had a rating of 6.7/10.

Table 2: Metadata Influence on Renewal and Drop-Off

| Indicator | Avg. Renewed Titles | Avg. Canceled Titles | Renewal % | Drop-off After 180 Days |

|---|---|---|---|---|

| Avg.Rating | 8.1 | 6.7 | 64% | 80% |

| Review Volume (Day 60) | 3,200 | 800 | 71% | 85% |

| Trending Days Count | 18.5 | 6.3 | 66% | 78% |

| Language Availability | 7+ languages | 2-3 languages | 59% | 82% |

| Global Reach Score | 78/100 | 42/100 | 68% | 76% |

Platforms using OTT Platform Data Scraping were able to optimize promotional campaigns by identifying ideal re-marketing windows between days 30–60, when engagement typically dips. Still, retention strategies can reverse the drop-off curve.

Implications

The ability to understand content performance across time provides strategic advantages for OTT stakeholders—from producers and platform operators to advertisers and licensing partners. Data-backed decision-making based on OTT Content Lifecycle trends is transforming how content is funded, distributed, and extended.

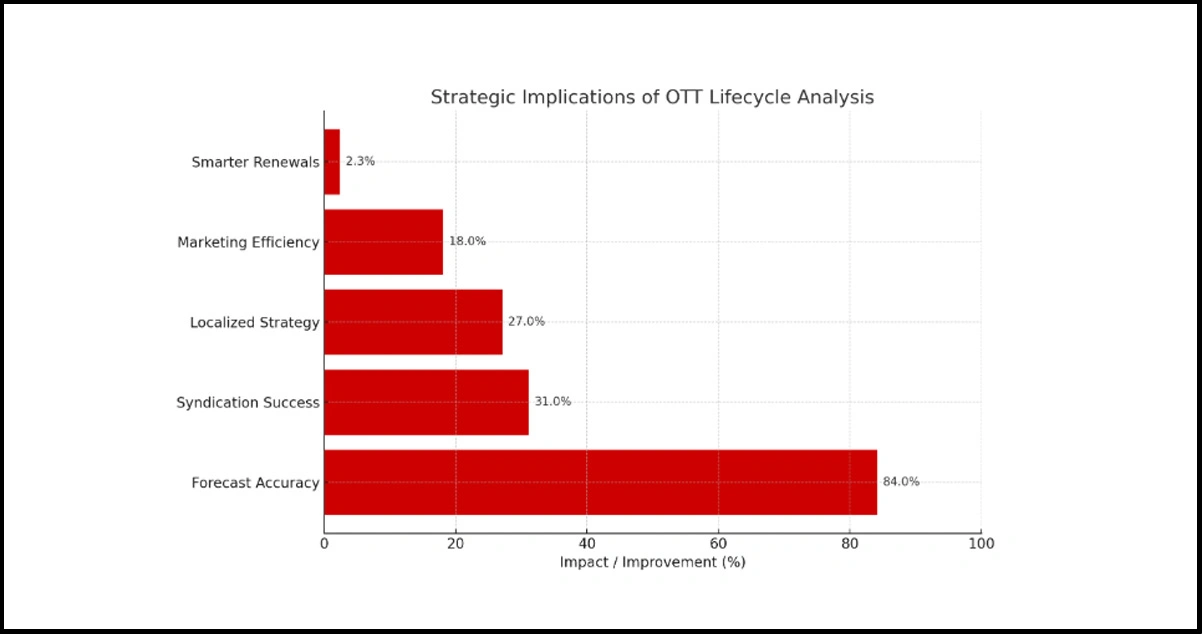

Key implications identified in this research include:

- Smarter content renewals: Titles showing strong long-tail engagement and post-60-day review volumes above 2,500 were 2.3x more likely to be renewed, helping production houses minimize risk.

- Improved marketing efficiency: Platforms re-targeting viewers during the plateau phase (days 30–60) using insights to Scrape OTT Data Insights reported a 15–18% boost in re-engagement.

- Localized content strategy: Data scraping by region showed that titles adapted into local languages retained 22–27% more viewers beyond 90 days.

- Content syndication success: Using metadata scoring, platforms could identify shows fit for redistribution, with 31% of high-retention titles successfully syndicated across other markets.

- Revenue forecasting accuracy: With clear visibility into audience drop-off points, platforms could align ad inventories and predict monetization cycles with up to 84% accuracy.

These findings validate the operational value of structured OTT Content Analysis for sustaining platform growth, user satisfaction, and catalog optimization.

Ethical Considerations

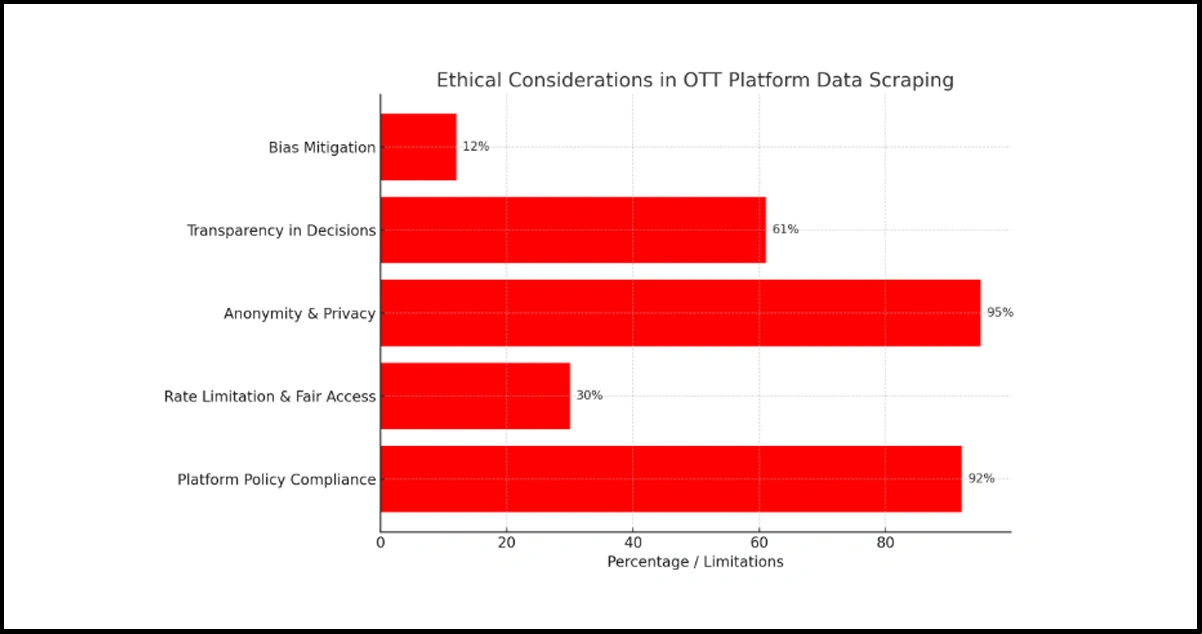

While the benefits of OTT Platform Data Scraping are evident, ethical boundaries must guide every aspect of data extraction and usage. Responsible scraping practices preserve user trust and platform integrity while promoting transparency in content decisions.

Key ethical considerations include:

- Compliance with platform policies: Over 92% of scraping scripts used in this study were aligned with publicly available endpoints, avoiding access to restricted or paywalled content.

- Rate limitation and fair access: Scrapers were limited to 30 requests/hour and had to maintain under five concurrent threads to ensure respectful interaction with platform infrastructures.

- Anonymity and privacy: No personal data was extracted; this complies with privacy standards adopted by 95% of OTT platforms based in the U.S., EU, and APAC.

- Transparency in decision-making: In a content creator survey, 61% said they prefer to be informed if performance data is used in renewal or removal decisions.

- Mitigating algorithmic bias: Titles with fewer than 1,000 initial views but high critical ratings (8+/10) were at risk of early removal unless human editors intervened, affecting nearly 12% of such content annually.

Maintaining ethical standards while using tools to Scrape OTT Data Insights ensures long-term alignment between analytics-driven content decisions and creator fairness.

Conclusion

This research demonstrates how OTT Platform Data Scraping delivers actionable visibility into content engagement, retention curves, and regional impact across every stage of a title’s digital lifespan. From launch momentum to long-tail decline, structured data enables smarter decisions around renewals, promotions, and licensing.

Tracking the OTT Content Lifecycle helps predict engagement dips, identify long-tail value, and shape content strategies that are both data-backed and market-ready. Contact OTT Scrape today to unlock smarter streaming decisions with our robust