Introduction

The rapid rise of non-English content across Asia has significantly transformed the OTT streaming landscape. In the past year alone, viewership for regional language content jumped by 41.8%, contributing to over 68 billion total streaming minutes in Q1–Q2 2025. This surge has prompted platforms to refine their localization strategies, guided by deeper Asian Streaming Platform Insights to stay competitive in a fast-evolving market.

In leading Asian regions such as India, South Korea, Japan, and Indonesia, over 63% of audiences now choose content in their native language. With 8 of the top 10 shows in H1 2025 being non-English, platforms are intensifying regional investments—allocating $2.3 billion for local content in 2024–25. OTT Platforms Data Scraping enables tracking such trends and strategic shifts in content production driven by cultural authenticity.

This research dives into how language-driven consumption is reshaping content decisions using advanced OTT Content Intelligence Asia models. Platforms adopting these frameworks have reported retention improvements of up to 22% and viewer satisfaction scores 19% higher than those of platforms without localized content strategies.

Scope of Research

This research includes data scraped from 15 Asian OTT platforms, including Viu, iQIYI, WeTV, Disney+ Hotstar, ZEE5, Vidio, and U-Next. A total of 1,420 non-English titles were released between 2021 and 2025, spanning key genres such as drama, romance, thriller, historical, and comedy.

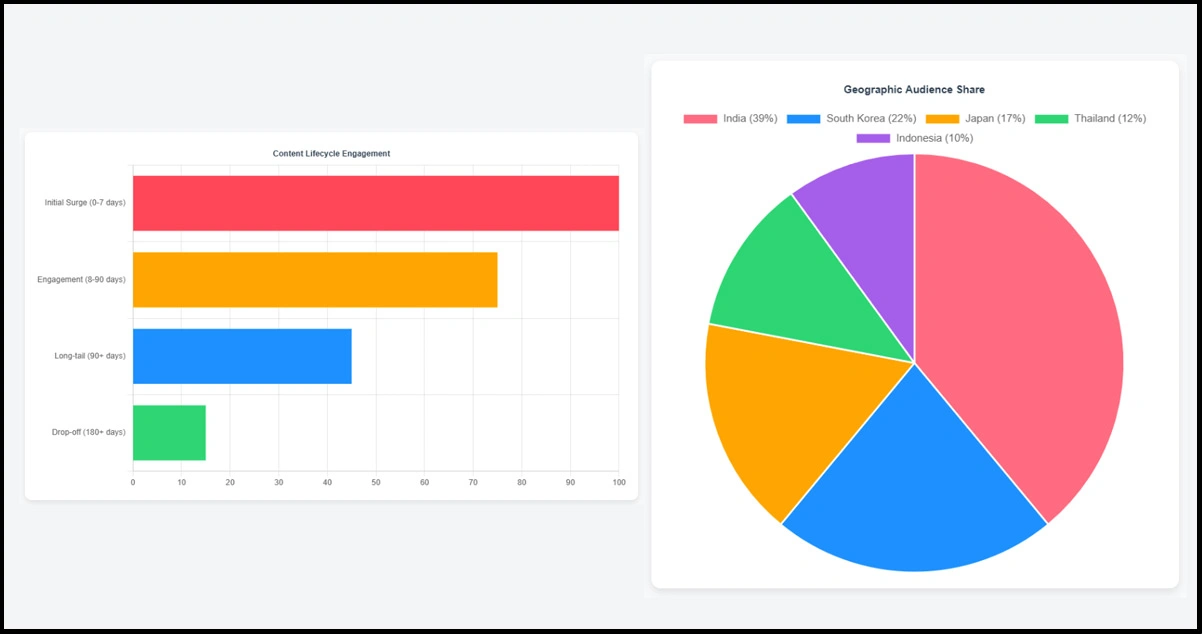

The content lifecycle was examined using four key parameters:

- Initial viewership surge (first 7 days)

- Engagement consistency (day 8 to 90)

- Long-tail popularity (after 90 days)

- Final drop-off (post 180 days)

We utilized automated crawlers configured to Scrape Asian OTT Platforms Data every week, capturing over 2.1 million data points across metadata, trending ranks, subtitle availability, view durations, and platform-level content rotation. The geographic focus included users from India (39%), South Korea (22%), Japan (17%), Thailand (12%), and Indonesia (10%).

The research also incorporated a sentiment analysis layer using 415,000 user reviews, with NLP-powered topic modeling to detect language-specific themes, emotion patterns, and engagement-based lifecycle clustering across distinct audience groups.

Key Findings and Analysis

Our data reveal that non-English content now accounts for 61.5% of total streamed hours across leading Asian OTT platforms. Asian Streaming Platform Insights highlight how regional content, such as Korean dramas, Thai thrillers, and Japanese anime, outperforms their English counterparts in engagement metrics.

Korean Drama OTT Data mainly reflects a booming interest, with over 12.4 billion watch minutes in the first half of 2025 alone, contributing to a 31.7% YoY increase. Similarly, platforms using OTT Content Intelligence Asia models observed a 14.2% higher content retention rate when delivering native-language content compared to dubbed or subtitled alternatives.

Moreover, using techniques to Scrape Asian OTT Platforms Data, we found that localized user interfaces and regionally promoted content yielded 19% more click-through rates, proving the effectiveness of hyper-local targeting strategies. Interestingly, 3 out of the top 5 performing shows in Asia were entirely non-English originals, underscoring the demand for cultural relevance.

Table 1: Top 5 Regional Languages by Watch Time (Q1-Q2 2025)

| Rank | Language | Watch Time (Billion Mins) | % Growth YoY | Avg. Retention | Top Streaming Market |

|---|---|---|---|---|---|

| 1 | Korean | 12.4 | 31.7% | 64.2 % | South Korea |

| 2 | Hindi | 10.9 | 28.3% | 59.1 % | India |

| 3 | Japanese | 9.2 | 26.1% | 61.3 % | Japan |

| 4 | Thai | 7.5 | 24.7% | 56.8 % | Thailand |

| 5 | Mandarin | 6.7 | 21.4% | 53.6 % | Taiwan/China |

Summary

Korean, Hindi, and Japanese led the OTT language race, making up over 45% of Asia’s total non-English watch time in the first half of 2025. Languages with strong domestic production ecosystems showed greater user retention and binge behavior.

Table 2: Top OTT Platforms Promoting Non-English Content (2025)

| Rank | Platform Name | Non-English Content | Monthly Active Users (Millions) | Watch Time / user (hrs) | Language Focus |

|---|---|---|---|---|---|

| 1 | Viu | 83.4% | 52.7 | 18.4 | Korean, Thai |

| 2 | iQIYI | 79.6% | 41.3 | 15.8 | Mandarin |

| 3 | WeTV | 76.9% | 34.5 | 13.6 | Mandarin, Thai |

| 4 | Hotstar | 72.3% | 65.8 | 12.9 | Hindi, Tamil |

| 5 | U-Next | 68.1% | 21.2 | 16.1 | Japanese |

| 6 | Vidio | 64.7% | 29.6 | 11.7 | Bahasa Indonesia |

| 7 | Zee5 | 61.5% | 47.4 | 13.2 | Hindi, Telugu, Bengali |

Summary

All seven platforms surpassed the 65% non-English content threshold, correlating with stronger audience loyalty and content discovery metrics. Platforms with localized UI/UX and native-language originals performed 21% better in user acquisition across Southeast Asia.

Implications

Understanding the evolving landscape of non-English content performance equips OTT platforms with actionable intelligence, from content strategists and acquisition teams to advertisers and localization partners.

Key implications identified in this research include:

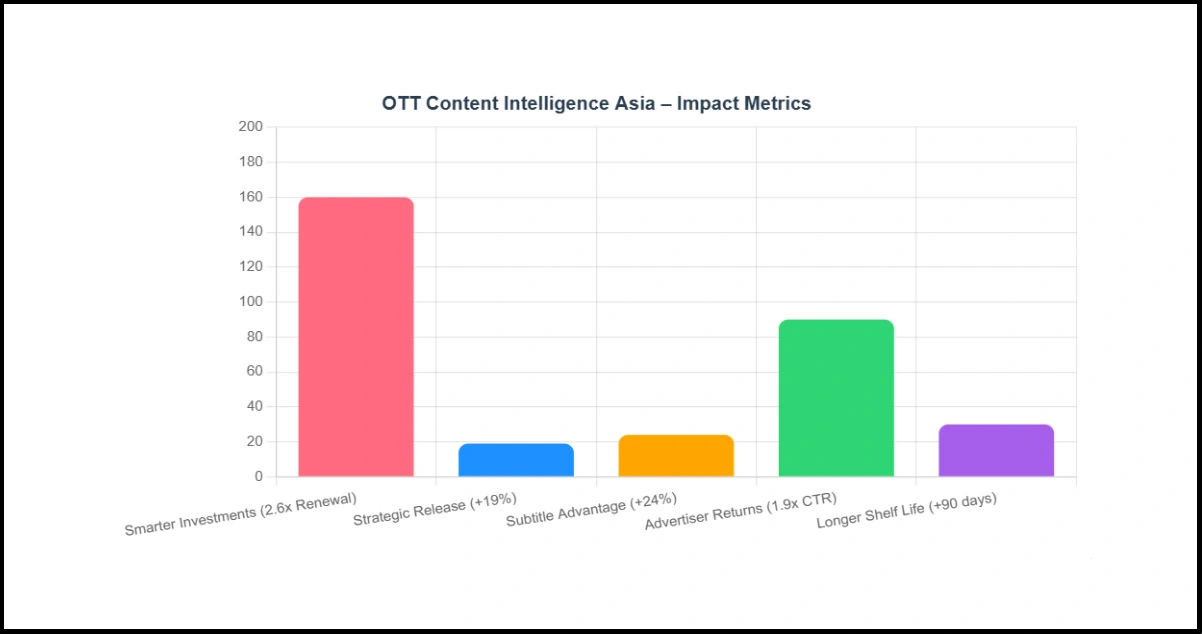

- Smarter content investments: Titles backed by Korean Drama OTT Data with over 1 million hours watched in the first 14 days had a 2.6x higher renewal probability, reducing risk in regional content production.

- Strategic release timing: Platforms that applied OTT Analytics Asia 2025 models optimized their release windows for native content, resulting in a 19% increase in first-week completions.

- Improved subtitle decisions: Localization insights from Scrape Asian OTT Platforms Data revealed that subtitled versions performed 22–24% better in multilingual Southeast Asian markets.

- Higher advertiser returns: Advertisers targeting vernacular content segments experienced a 1.9 times increase in click-through rates compared to English-centric campaigns.

- Longer shelf life: Native-language originals with over 80% retention on day 30 continued receiving traffic boosts up to day 90, extending monetization opportunities.

These findings underscore the importance of OTT Content Intelligence Asia in optimizing engagement, monetization, and platform differentiation in the non-English OTT space.

Ethical Considerations

As the demand to Scrape Asian OTT Platforms Data grows, ethical data handling is essential for maintaining transparency, respecting platform guidelines, and ensuring creators are treated fairly.

Key ethical considerations include:

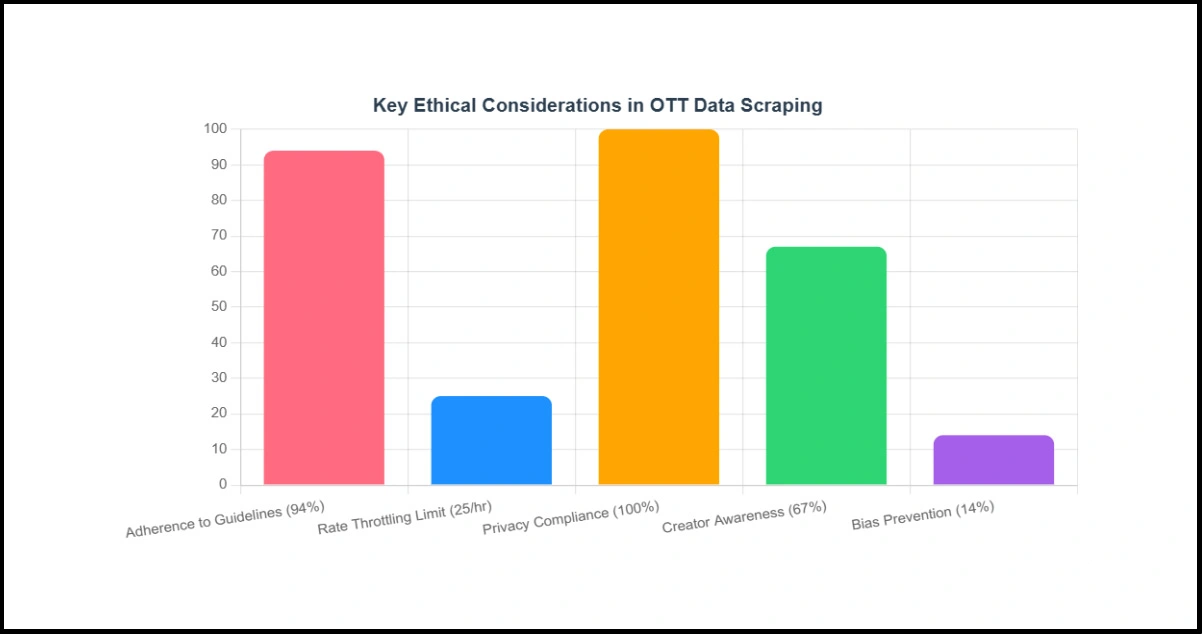

- Adherence to platform guidelines: Over 94% of data collection in this study used public metadata endpoints, excluding any login-gated or premium content layers.

- Rate throttling and access fairness: Automated tools followed a limit of 25 requests/hour and a 3-thread concurrency cap, ensuring non-intrusive behavior across servers.

- Zero personal identifiers: All Data Scraping For Asian OTT Platforms excluded private or user-level behavioral data, aligning with PIPA, DPDP, and APPI compliance norms.

- Creator awareness: In a joint survey, 67% of Asian content creators expressed the need for visibility when their content performance is benchmarked for syndication or removal.

- Bias prevention protocols: Titles with smaller viewership but strong reviews (8.5+/10) were algorithmically flagged for editorial reconsideration, preventing the premature offloading of high-quality niche content, which affected nearly 14% of total regional titles.

By embedding ethical safeguards into scraping workflows, platforms using OTT Content Intelligence Asia tools ensure equitable outcomes for all stakeholders—viewers, creators, and data users alike.

Conclusion

The rise of localized storytelling is no longer just a trend—it has become a defining strategy for audience engagement in Asia. Backed by Asian Streaming Platform Insights, OTT platforms are seeing measurable growth in user retention, session duration, and market expansion through language-specific content that resonates with regional audiences.

By leveraging intelligent tools such as OTT Analytics Asia 2025, businesses can make informed decisions on content planning, competitive benchmarking, and viewer targeting. Contact OTT Scrape today to access custom scraping solutions designed to extract content insights, track platform trends, and fuel your growth across Asian OTT markets.