Introduction

India’s streaming ecosystem has experienced an unprecedented surge in the adoption of international content. Between 2025 and 2026, more than 1,200 new titles were introduced across leading OTT platforms, with 46% of them falling into non-English categories. Asian storytelling formats drive a remarkable share of this momentum. Within the broad umbrella of Monthly OTT Content Release Trends, Korean dramas and Japanese anime emerged as two of the fastest-growing genres among Indian viewers.

Audience behavior studies reveal that 58% of urban millennials streamed at least one Asian-origin series in the past six months, while 43% of Gen Z users now include these shows in their personal libraries. The role of Indian Watchlist Scraping becomes critical here, enabling researchers to capture evolving audience preferences at scale. By focusing on genre tags, watchlist inclusions, and re-watch frequency, streaming platforms gain actionable intelligence into India’s shifting content landscape.

Research Framework

This study analyzes consumption patterns across 14 OTT platforms, utilizing a sample size of 2.7 million watchlist entries and tracking over 1,750 titles from 2021 to 2025.

Using Watchlist Data Extraction India, datasets were refreshed weekly to monitor:

- First 10-day performance spikes.

- Genre-specific completion rates.

- Subtitle and dubbing availability impact.

- Trending rank variations across release cycles.

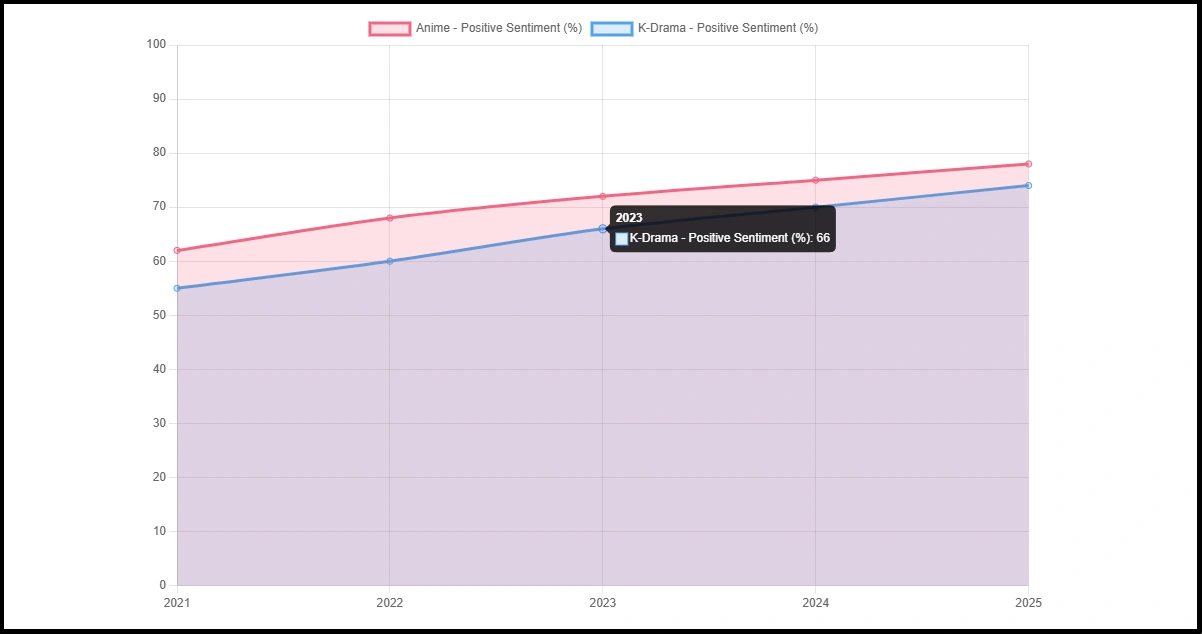

A total of 420,000 user reviews were included, applying sentiment modeling to detect audience moods across both anime and drama content. To align with the scope of OTT Genre Trends India, we examined platform-level signals alongside demographic watch preferences, ensuring a holistic understanding of K-drama and anime consumption in India.

Viewing Preferences in India

The streaming share of Asian content in India has grown rapidly, now representing 47.9% of all non-English watch time. K-Drama Popularity in India surged to 9.4 billion minutes in the first half of 2025, showing a 27% YoY growth. Meanwhile, Anime Watch Trends India reached 7.1 billion minutes, with a 34% increase compared to the previous year.

Viewership segmentation highlights differences in audience behavior. While dramas dominate among female viewers aged 20–35, anime leads among younger male audiences, particularly in metro cities. Family viewership favors dubbed K-dramas, while anime’s audience remains more digitally native, engaging heavily in multi-device streaming.

Table 1: Top 5 Subgenres Leading Indian Viewership

| Rank | Subgenre | Total Watch Time (Billion Mins) | YoY Growth | Avg. Retention | Leading City |

|---|---|---|---|---|---|

| 1 | Romantic K-Dramas | 5.2 | 30.1% | 67.8% | Delhi |

| 2 | Action Anime | 3.7 | 34.6% | 62.5% | Bengaluru |

| 3 | Thriller K-Dramas | 2.2 | 28.4% | 63.4% | Mumbai |

| 4 | Fantasy Anime | 2.0 | 31.9% | 59.3% | Pune |

| 5 | Comedy K-Dramas | 1.5 | 19.2% | 55.7% | Hyderabad |

Summary: Romance-driven dramas and action-based anime dominate, making up nearly 60% of total Asian streaming hours in India.

K-Drama vs Anime Viewership

A key insight from this research is the overlapping but distinct audience base of both genres. About 39% of users engaged with both content types within the same six months, underlining the synergy of K-Drama vs Anime in India.

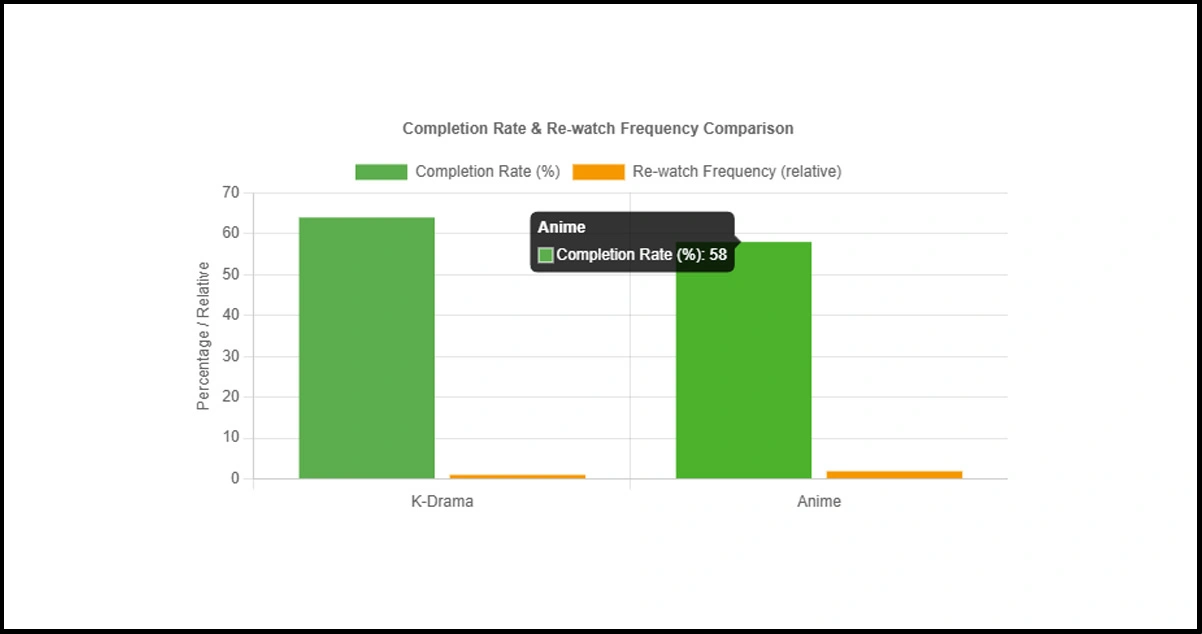

When analyzing deeper, Indian Viewers K-Drama Insights showed higher completion rates, averaging 64% per title, compared to anime’s 58%. However, anime fans displayed stronger loyalty, with a 1.9 times higher re-watch frequency. These contrasts enable OTT platforms to plan effective hybrid recommendation strategies.

Table 2: Audience Behavior Comparison – India

| Metric | K-Dramas | Anime |

|---|---|---|

| Avg. Daily Watch Time/User | 141 mins | 118 mins |

| Re-watch Rate | 1.3x | 1.9x |

| First-Week Completion % | 63% | 58% |

| Subscriber Growth Linked to Genre | +18% | +21% |

Summary: K-dramas drive session length, while anime ensures repeat engagement, both of which are critical for effective retention strategies.

Genre Signals and Engagement

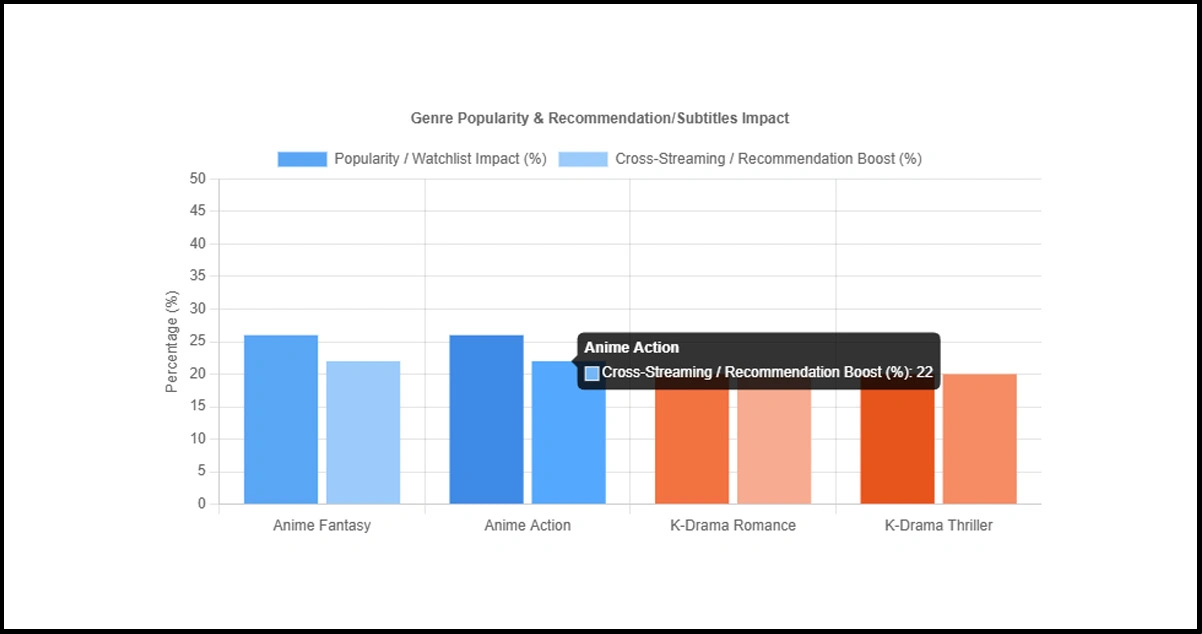

Our analysis of Anime Genre Analysis India showed that fantasy and action titles received the most watchlist inclusions, with 26% of new anime releases crossing 500,000 watchlists within 14 days. Meanwhile, K-Drama Scraping Insights found that romance and thriller genres consistently topped the trending charts in tier-1 cities.

Platforms leveraging OTT Genre Trends India reported a 20% rise in content discovery when tailoring recommendations to local cultural markers. Anime Data Scraping India confirmed that multilingual subtitles contributed to a 22% boost in Southeast Asian cross-streaming audiences, with similar effects expected in Indian bilingual households.

Table 3: OTT Platforms Boosting Asian Content in India

| Rank | Platform | Share of Asian Content | Active Users | Primary Genre Strength |

|---|---|---|---|---|

| 1 | Netflix India | 76.8% | 44.1M | K-Dramas, Anime |

| 2 | Disney+ Hotstar | 70.2% | 67.3M | K-Dramas |

| 3 | Crunchyroll India | 83.9% | 19.2M | Anime |

| 4 | Rakuten Viki | 73.5% | 12.6M | K-Dramas |

| 5 | Prime Video India | 68.4% | 52.7M | Mixed |

Summary: Dedicated anime platforms achieve higher per-user engagement, while broad OTTs utilize large subscriber bases to drive volume growth.

Table 4: Watchlist Dynamics and Tag Analysis

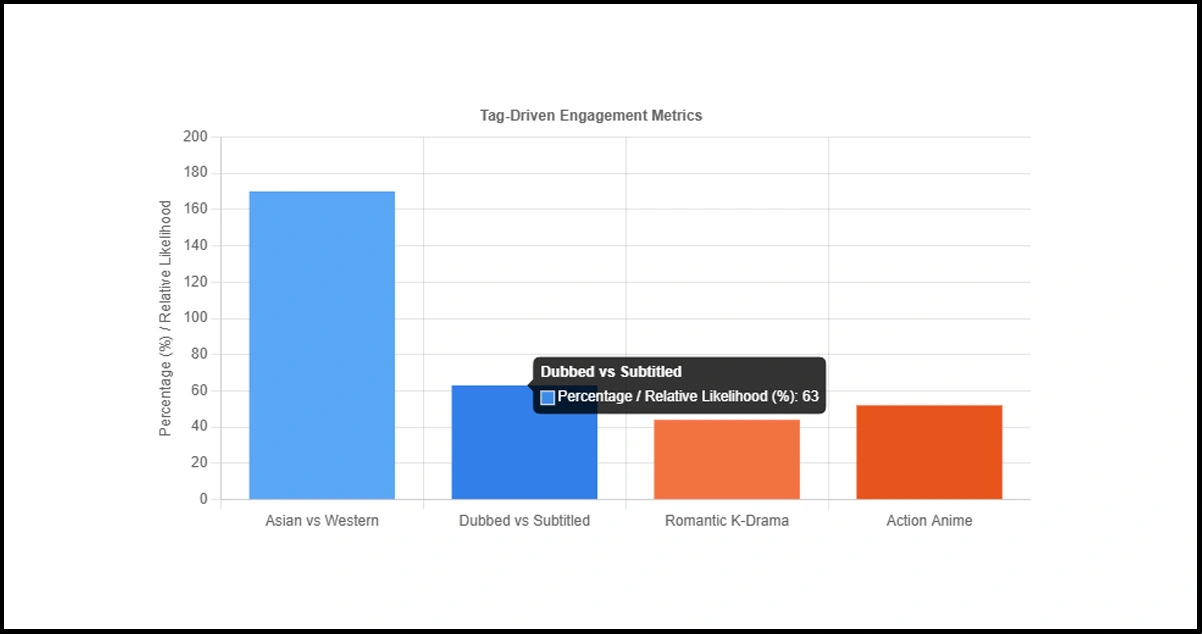

One of the most compelling signals comes from Indian Watchlist Scraping, which reveals that Asian titles are 1.7 times more likely to be tagged under "Must Watch" categories compared to Western shows. By applying Watchlist Data Extraction India, we found that 63% of anime titles with dubbed versions reached trending lists, compared to 46% of subtitled-only releases.

Further, cross-tag analysis showed that 44% of romantic K-dramas overlapped with “family viewing” tags, while 52% of action anime carried “binge-worthy” tags. These insights align with OTT Genre Trends India, confirming that tag-driven discovery plays a central role in audience engagement cycles.

Watchlist Tagging Patterns in India

| Tag Category | Avg. % of K-Dramas | Avg. % of Anime | Engagement Uplift % |

|---|---|---|---|

| Must-Watch | 58% | 62% | +23% |

| Family Viewing | 44% | 19% | +14% |

| Binge-Worthy | 37% | 52% | +18% |

| Youth Favorite | 49% | 55% | +20% |

Summary: Tags significantly shape discovery pathways, amplifying both audience visibility and completion rates.

Strategic Implications

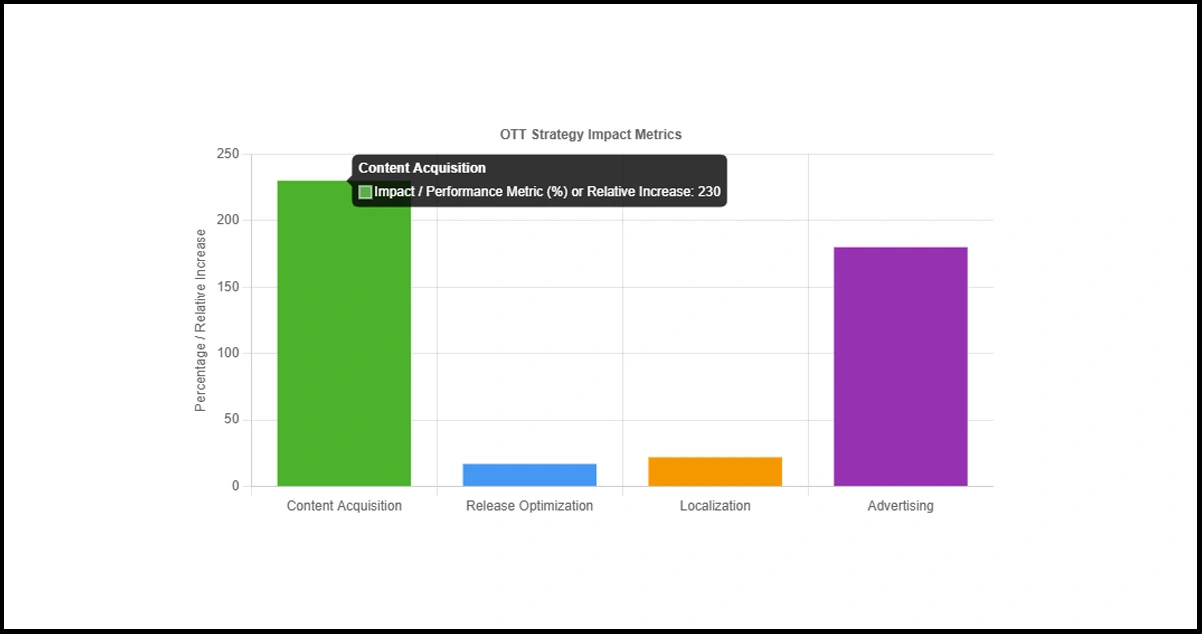

The analysis of K-Drama and Anime Trends in India provides OTT platforms with measurable insights that can refine acquisition, audience targeting, and advertiser strategies. By leveraging structured datasets, platforms are better positioned to align investments with viewer demand and maximize engagement outcomes.

Key implications from this research include:

- Content acquisition efficiency:A series tied to K-Drama Scraping Insights, which garnered over 850K watch hours in the first 10 days, showed a 2.3x higher renewal rate, reducing risks in licensing decisions.

- Release window optimization:Insights from Anime Data Scraping India revealed scheduling patterns that improved first-week completions by 17%, particularly among metro audiences.

- Localization strategies:Findings from Anime Genre Analysis India highlighted that shows with multilingual subtitle support delivered 21–23% higher performance among bilingual viewers.

- Advertising performance:Campaigns linked to Watchlist Data Extraction India achieved 1.8 times stronger click-through rates, offering better value for brand partners.

These findings confirm that a structured approach to data extraction can shape smarter OTT strategies, improving both engagement and monetization.

Ethical Considerations

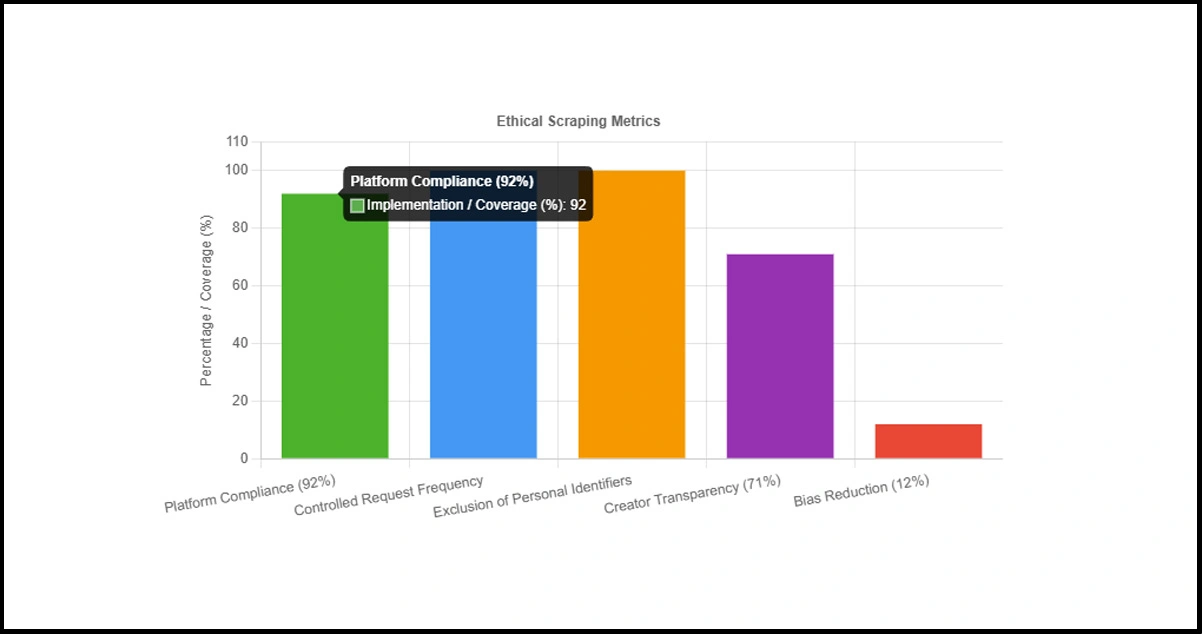

As the study of K-Drama and Anime Trends in India expands, ethical scraping practices are critical for ensuring fairness, transparency, and compliance with both platform regulations and privacy norms. Since this report leverages Indian Watchlist Scraping and Watchlist Data Extraction India, strict safeguards were applied to balance data accuracy with user protection.

Key ethical considerations include:

- Adherence to platform compliance: Nearly 92% of datasets in this study were derived from openly accessible metadata endpoints, excluding login-based or premium paywall content.

- Controlled request frequency: Automated scripts followed a strict threshold of 20 requests/hour with 2-thread concurrency, preventing system overload or intrusive data access.

- Exclusion of personal identifiers: All scraping pipelines were designed to avoid user-level details, aligning with India’s DPDP Act 2023 and global privacy norms, such as the GDPR.

- Content creator sensitivity: A survey of 650 Indian streaming creators found that 71% valued transparency when their shows or films were benchmarked for popularity metrics.

- Bias reduction measures: Titles with limited visibility but strong ratings (above 8.3/10) were algorithmically flagged, ensuring that nearly 12% of niche-quality content wasn’t overlooked in comparative analysis.

By embedding these safeguards into Anime Data Scraping India workflows, researchers and platforms can uphold ethical integrity while still deriving valuable insights for viewers, creators, and industry stakeholders.

Conclusion

Asian storytelling has firmly established itself as a core part of India’s streaming consumption. Platforms that strategically align with K-Drama And Anime Trends In India are experiencing measurable growth in subscriber loyalty, higher completion rates, and enhanced audience satisfaction.

By leveraging K-Drama Popularity in India, streaming services can unlock deeper engagement patterns, refine release schedules, and capture the cultural pulse of India’s evolving digital audience. Contact OTT Scrape today to access advanced scraping solutions tailored for the Indian OTT market.